Insurance firms have traditionally been hesitant to integrate digital technologies into their processes, much like the banking and finance industries. The complexity of internal operations and rigorous regulatory restrictions are the key contributors to this slowness. Poor customer service and unhappiness with the services are the results of this. A new trend in insurance called InsurTech has emerged to address all of the above-mentioned problems.

Insurance businesses can efficiently address a variety of industry-wide problems thanks to InsurTech. This article will describe in detail everything that you need to know about this beautiful and revolutionary culmination of insurance and technology.

Any insurance company that uses the power of digital technologies to improve its services and internal procedures is referred to as using InsurTech. Even if any insurance firm can use digital technology in their operations today, the rise of InsurTech sparked the formation of new companies and startups that began fusing insurance services with digital solutions. The popularity of InsurTech is rising quickly, and more and more traditional insurance businesses are looking for methods to work with IT service providers to modernize their outdated systems.

Technology is known to ease numerous business activities while also providing many advantages. Some of the ways insurers can utilize insurance IT tech solutions are listed below.

1. Improved Data Analysis:

Using big data analytics, insurance businesses may do more accurate risk parameter assessment, forecast insurance events better, make data-driven decisions, and give their clients tools to help them evaluate different insurance plans and select the best alternative.

2. Instant Service:

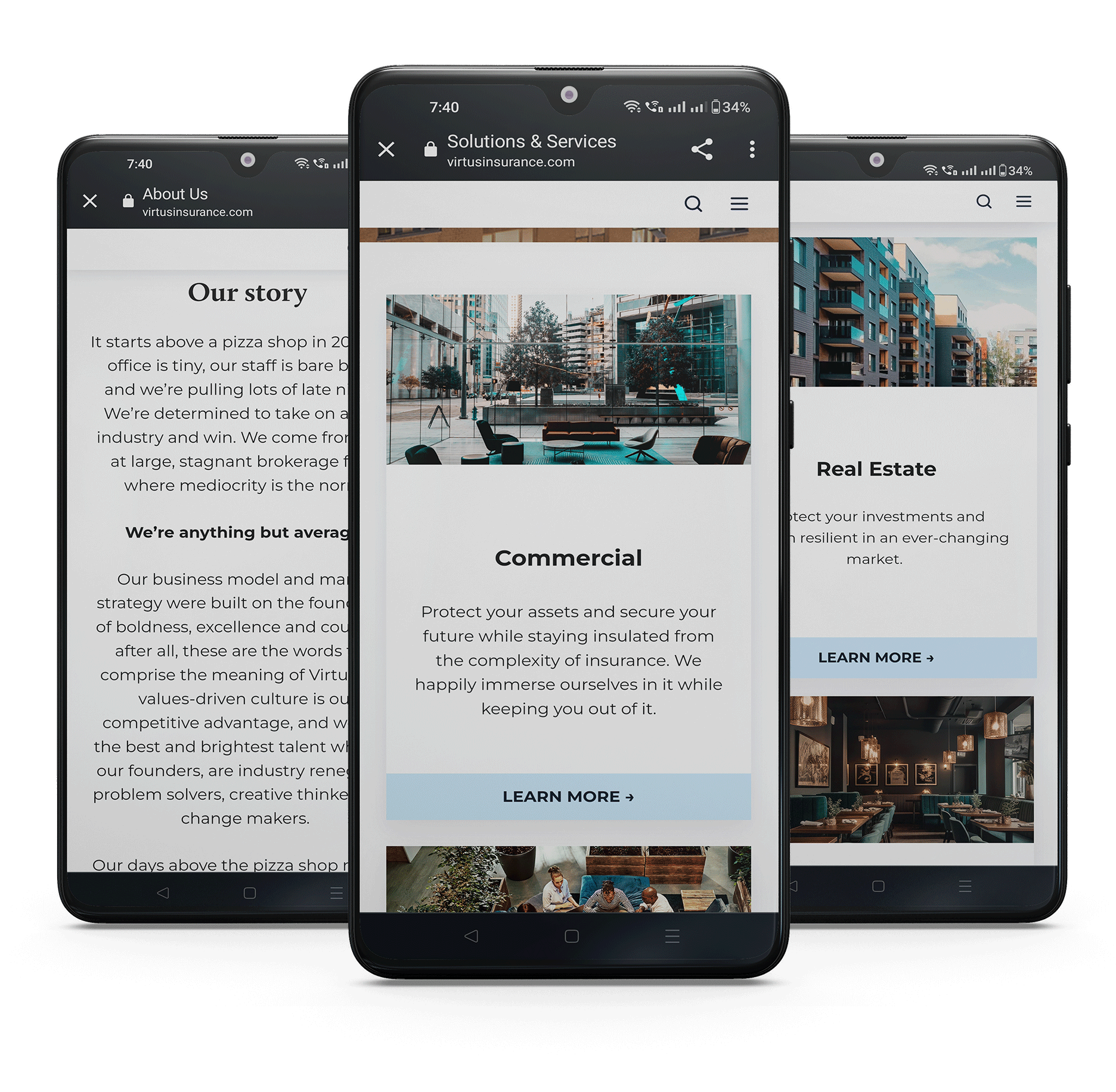

Customers can now order insurance services online or using a mobile app, eliminating the need to visit physical locations to buy or renew insurance plans.

3. Personalized Services:

Insurance companies can enhance their online presence by offering their services through various Internet sources, such as social media, custom-developed mobile and web applications, and others. This helps them build strong relationships with their customers and learn more about the quality of their services. Moreover, by the use of wearables, mobile apps, and IoT technologies, insurance companies gain access to a wider range of information on their clients that is analyzed with the help of the hivemind algorithm.

Some of the technology trends that are being widely used in Insurance Tech are listed:

1. Artificial Intelligence (AI):

The foundation for many features that can be included in InsurTech systems is artificial intelligence (AI). The most well-known functions that AI supports are advanced and predictive analytics. Large volumes of data may be quickly processed by artificial intelligence, which can also identify any existing patterns. AI gives insurers the final results, which they can utilize to get more insights, by comparing these patterns.

With the use of technology, businesses may eliminate large paper document archives and replace them with useful digital resources. Digital assistants and chatbots also significantly rely on AI. Through 24-hour customer care, these software agents can assist businesses in improving contact with their clients.

2. Internet of Things (IoT):

IoT technology has several uses in the services provided by InsurTech firms. If a customer uses a smart gadget that reduces the risk of an insurance occurrence, they may provide them with a limited number of discounts. For instance, installing flood or fire detectors in their homes, installing mileage and over-speed limiters in cars, and much more.

IoT is a tool that can be utilized for insurance personalization in addition to risk reduction. For instance, based on personal health indicators offered by different wearable technology.

3. Drones:

Drones can successfully monitor vast regions, such as farmlands, allowing InsurTech companies to stop crop loss and other harms. Drones can check these locations and decide how much to pay for insurance claims thanks to AI-based software. InsurTech assists businesses in this way by drastically reducing costs, reducing the need for human interaction, and speeding up decision-making.

There are many pre-made insurance software options available on the market, each ideal for a different situation. There are numerous other sorts of insurance apps as well, such as those for health, travel, business, and real estate. These categories can be viewed differently by agents, brokers, and software providers, who may also have specific functional requirements for each type of software. As a result, even while these solutions may be highly reliable and secure, they may still be difficult to use.

If an insurance provider looks for a middle ground that mixes different insurance services, such as travel and auto insurance, the problem could get worse. The ideal choice might have been to select multiple programs and pay for two or three different pieces of software. However, creating your own unique insurance program is a lot more effective solution to handle the problem.

Companies can be confident that when developing custom insurance software, just the functionality required for their particular business is included. Additionally, businesses can always add or remove stand-alone features without compromising any essential functionalities in the event that their business objectives alter. Companies may equip their software with the newest technology, from AI for advanced analytics to Blockchain for increased transparency, in addition to only using the most crucial business functionality

We’ve made the insurance platform better by creating a solution that makes scanning and understanding documents seamless. This improvement ensures a smoother experience for users dealing with insurance paperwork, allowing them to access information quickly and efficiently.

The newest digital technologies are utilized by InsurTech businesses to improve their digital solutions and offer exceptional services to both their clients and customers. Traditional insurance providers can improve their services and reach new consumer demographics with the help of these solutions. Therefore, companies who are simply thinking about integrating digital technology into their workflow should start doing so right away.

Leave your competitors behind! Become an EPIC integration pro, and boost your team's efficiency.

Register Here

The Mindbowser team's professionalism consistently impressed me. Their commitment to quality shone through in every aspect of the project. They truly went the extra mile, ensuring they understood our needs perfectly and were always willing to invest the time to...

CTO, New Day Therapeutics

I collaborated with Mindbowser for several years on a complex SaaS platform project. They took over a partially completed project and successfully transformed it into a fully functional and robust platform. Throughout the entire process, the quality of their work...

President, E.B. Carlson

Mindbowser and team are professional, talented and very responsive. They got us through a challenging situation with our IOT product successfully. They will be our go to dev team going forward.

Founder, Cascada

Amazing team to work with. Very responsive and very skilled in both front and backend engineering. Looking forward to our next project together.

Co-Founder, Emerge

The team is great to work with. Very professional, on task, and efficient.

Founder, PeriopMD

I can not express enough how pleased we are with the whole team. From the first call and meeting, they took our vision and ran with it. Communication was easy and everyone was flexible to our schedule. I’m excited to...

Founder, Seeke

Mindbowser has truly been foundational in my journey from concept to design and onto that final launch phase.

CEO, KickSnap

We had very close go live timeline and Mindbowser team got us live a month before.

CEO, BuyNow WorldWide

If you want a team of great developers, I recommend them for the next project.

Founder, Teach Reach

Mindbowser built both iOS and Android apps for Mindworks, that have stood the test of time. 5 years later they still function quite beautifully. Their team always met their objectives and I'm very happy with the end result. Thank you!

Founder, Mindworks

Mindbowser has delivered a much better quality product than our previous tech vendors. Our product is stable and passed Well Architected Framework Review from AWS.

CEO, PurpleAnt

I am happy to share that we got USD 10k in cloud credits courtesy of our friends at Mindbowser. Thank you Pravin and Ayush, this means a lot to us.

CTO, Shortlist

Mindbowser is one of the reasons that our app is successful. These guys have been a great team.

Founder & CEO, MangoMirror

Kudos for all your hard work and diligence on the Telehealth platform project. You made it possible.

CEO, ThriveHealth

Mindbowser helped us build an awesome iOS app to bring balance to people’s lives.

CEO, SMILINGMIND

They were a very responsive team! Extremely easy to communicate and work with!

Founder & CEO, TotTech

We’ve had very little-to-no hiccups at all—it’s been a really pleasurable experience.

Co-Founder, TEAM8s

Mindbowser was very helpful with explaining the development process and started quickly on the project.

Executive Director of Product Development, Innovation Lab

The greatest benefit we got from Mindbowser is the expertise. Their team has developed apps in all different industries with all types of social proofs.

Co-Founder, Vesica

Mindbowser is professional, efficient and thorough.

Consultant, XPRIZE

Very committed, they create beautiful apps and are very benevolent. They have brilliant Ideas.

Founder, S.T.A.R.S of Wellness

Mindbowser was great; they listened to us a lot and helped us hone in on the actual idea of the app. They had put together fantastic wireframes for us.

Co-Founder, Flat Earth

Ayush was responsive and paired me with the best team member possible, to complete my complex vision and project. Could not be happier.

Founder, Child Life On Call

The team from Mindbowser stayed on task, asked the right questions, and completed the required tasks in a timely fashion! Strong work team!

CEO, SDOH2Health LLC

Mindbowser was easy to work with and hit the ground running, immediately feeling like part of our team.

CEO, Stealth Startup

Mindbowser was an excellent partner in developing my fitness app. They were patient, attentive, & understood my business needs. The end product exceeded my expectations. Thrilled to share it globally.

Owner, Phalanx

Mindbowser's expertise in tech, process & mobile development made them our choice for our app. The team was dedicated to the process & delivered high-quality features on time. They also gave valuable industry advice. Highly recommend them for app development...

Co-Founder, Fox&Fork