It is appalling to notice the difference a year can make! The coronavirus pandemic and the emerging economic fallout have drastically changed customers’ and workers’ needs, habits, and aspirations. The pandemic compelled the various industries of the economy to virtualize their operations; the insurance sector is no exception.

Different industrial sectors adapted to this shift quickly; insurers still face persistent obstacles to finding growth and profitability prospects. Regardless, this experience has paved the way to focus our efforts on innovation and investment in a digital future.

InsurTech plays a crucial role in integrating digital innovation with the insurance sector. Insurance technology trends modernize the traditional process of the insurance industry. These technologies enhance the efficiency and effectiveness of the operations of insurance companies.

New technologies will mold and shape the insurance industry. The Insurance technology trends will streamline various processes and smoothen up the road to developing various products catering to the current times and users.

Some insurance technology trends that can alter and transform the insurance industry are briefly discussed below.

Fig: Emerging Insurance Technology Trends

The adoption of Artificial Intelligence is gaining momentum across industries. With AI, insurance companies can enjoy various benefits like increased productivity, better customer experiences, and decreased fraud.

With chatbots powered by AI, you can answer your customers’ queries around the clock; from solving simple policy-related issues to addressing concerns and grievances, you can do it all.

Insurance companies can examine historical data through machine learning and AI and recognize a collection of models that can be used to identify fraud at an early stage and prevent it from occurring.

Artificial Intelligence in the insurance industry allows Insurers to streamline the end-to-end process with AI. From data collection, the formation of settlements, authorization, and acceptance to monitoring payment, tracking of salvage and recovery, and processing of legal matters to contact management.

These AI-powered bots will review the claim, verify policy information, look out for fraud, and process payments, making the claims process quicker and more effective.

Digital consumers demand sophisticated products at affordable costs. With Artificial Intelligence, insurance agents gain comprehensive insights into the demographics, preferences, purchasing habits, and other consumers’ data.

The agent will use this knowledge and information to involve clients in their background and pitch policies per their needs, allowing the insurance organizations to tap the opportunity.

Data Science in the insurance industry helps insurers to develop successful strategies for acquiring new clients, developing tailored products, assessing risks, assisting underwriters, implementing fraud detection systems, and much more. Data scientists can easily segment an insurance agency’s customers through financial assets, age, location, or other demographics.

After finding similarities in their behaviors, interests, actions, or personal details, classifying clients into various categories helps insurance providers create desirable and useful plans for each category. This results in targeted cross-selling capabilities and customized goods being introduced that can be successfully promoted.

We have already discovered that data science will help insurers create tailored solutions that are more attractive to clients. This recommendation engine algorithm will recognize the tastes and peculiarities in customers’ choices from their account behavior and suggest customized items immediately to improve upselling and cross-selling revenue.

Risk evaluation will greatly minimize insurance losses. One area where risk management solutions can be applied to reduce risks is insurance underwriting. The underwriter’s ability to recognize the risks involved in insuring a customer or an asset will directly affect the company.

Data science allows AI and cognitive analytics to evaluate a client’s policy documents and determine the appropriate premium quantity and coverage amount recommended for that policy. It would significantly increase the performance of underwriters, making it easier to process low-risk guidelines rapidly.

We’ve made the insurance platform better by creating a solution that makes scanning and understanding documents seamless. This improvement ensures a smoother experience for users dealing with insurance paperwork, allowing them to access information quickly and efficiently.

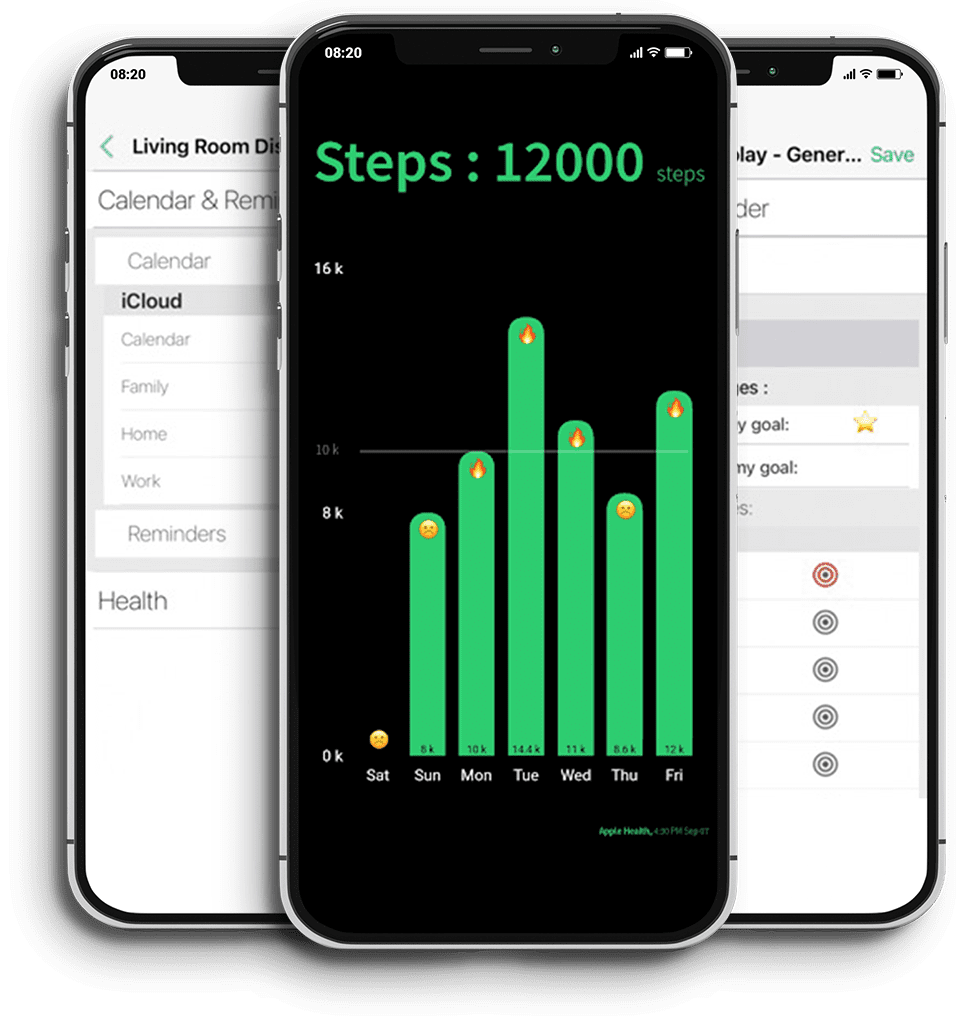

We built one of the most advanced Smart Mirrors for tracking healthcare data and providing actionable insights to the user to improve their health. The platform along with its mobile apps tracks user data from 100+ sources and puts them in front of the user on their bathroom mirror.

Currently, the Internet of Things in the insurance industry is in the middle of a significant digital transformation. Customers expect results immediately in today’s digitally savvy, fast-paced business climate. This is why businesses of every scale and line, including the insurance chain, are trying to enhance customer support and loyalty using digital means.

IoT allows data to be collected and exchanged continuously across networks, thereby speeding up and optimizing the claims process, minimizing data duplications, and largely eliminating customer frustrations. Customers will no longer have to waste months wading through paperwork, and now they can collect protection from their devices and handle claims more effectively.

Additionally, via digital media, they will finally have the means to track their coverage and claims easily. The insurance business model is focused on the risk management capacity of the insurance broker. This is why data has often been at the core of the insurance industry; the way insurance risk and returns are modeled heavily on information drives decisions.

Usually, insurers have had to rely on historical experience, long-term modeling, and information provided by the insured parties to produce reasonable risk groups. The constantly available data stream provided by IoT devices can dramatically alter this. It will allow insurers to make risk assessments that are vastly more detailed and personalized.

The good risk will always subsidize the bad risk, and there is no real way around it. More and more precise risk models, however, would result in more equal premiums. Data from connected devices would also enable insurers to understand their clients at a deeper, better level due to more detailed and comprehensive data.

Another technology that has grown popular over the years is cloud computing. It is undeniable that cloud computing in the insurance industry can allow insurance companies to manage their costs very smoothly.

The insurance industry will potentially save a huge amount of money by introducing cloud-based technology that could be invested in several other important areas. Also, cloud adoption ensures versatility and performance and enhances business processes.

Unlike conventional IT services, cloud computing requires very limited implementation time. It enables companies to optimize their outstanding services and functionality quickly. In addition, cloud computing has enough tools at its disposal that are adequate for the numerous users in the shared world.

Not only are these resources efficiently, but they are also scalable. With their stable features and flexibility, cloud-based applications help insurance companies minimize overhead costs and streamline operations. The insurers could free up space in their budget seamlessly and help the workers concentrate on more important items.

Robotic Process Automation in the insurance industry provides a non-invasive way to simplify key processes for insurance firms. In addition, automation offers a stable solution for an industry burdened with repetitive and mundane activities to maximize organizational effectiveness, customer loyalty, and profitability.

Large-volume claims forms can be carried out with just a third or half of the people needed compared to when the process was manual. This, in turn, has additional benefits because it provides immense relief for those who work on projects based on customers. Also, fewer individuals lead to fewer human errors that intimidate automated processes.

Compliance with privacy laws and handling investigations- internal and external- are the highest insurance companies’ standards. The need to keep current with ever-changing laws that prescribe how privacy should be protected increases the issue’s importance.

In this area, robotic process automation can also help a whole lot. Since the program produces comprehensive records of all transactions, it becomes much simpler to monitor the procedures and ensure that regulatory enforcement is in place. Therefore, external investigations are much less concern for insurance firms that use automation.

Since the advent of blockchain technology, we have seen the rise in its use and how it benefits various industries. The insurance sector can’t seem to avoid blockchain technology’s advantages. We have already seen a rise in the usage of blockchain development by major insurance industry players like AIG, Allianz, etc.

Integrating blockchain reduces administrative burdens and costs, improves security, and allows information sharing easily. Since the data stored on the blockchain is secure and cannot be altered, it can also help reduce insurance fraud.

Predictive analysis is a branch of advanced analytics that helps predict future outcomes using historical data. Insurers use it to gain meaningful insights and understand customer behavior. Various insurance companies are using predictive analytics to find out the risk status, frauds, outlier claims and future trends, which helps them in avoiding any mishaps and losses. It is being used extensively and is expected to be used with more and more precision in the future.

The rise of low-code development platforms has been in trend for a couple of years. It comes with various benefits, as applications developed using these platforms reduce the dependencies on developers and allow companies to develop and deploy updates much faster.

The insurance sector has also seen a rise in the use of these platforms, and the usage of these platforms is growing rapidly as they make managing apps easier. Low-code development platforms have taken over the market quickly. The insurance sector is also one of the markets adapting to these new platforms, as it has various benefits and can see massive growth in its usage over the coming years.

According to the research conducted by Finance Digest, more than 95% of all customer interactions will be powered by chatbots by 2025. Thanks to AI and machine learning, talking to customers through chatbots will become easier and more seamless.

The bots will be able to explain the policies and processes and answer customer queries without human intervention, saving the insurance companies a lot of time and cost. It also allows seamless interaction with the customers and 24×7 support. Some organizations are already using bots to interact with their customers, and this trend will continue to grow.

We live in an era where we are always connected with our devices, which constantly collect information about what we do, what we search for and what our interests are. Devices like smartphones and wearables collect the data and share it with organizations help them understand our needs and allowing these organizations to view customers as an individual rather than segment.

Insurance companies use this data to identify the needs and wants of their customers and create policies tailored to their needs. Using data to target customers allows for a better customer experience and also helps in accurate risk assessments.

Competition is everywhere; no matter the industry, organizations try to find every opportunity to make their place and gain new customers. The insurance industry has also seen a massive rise in competition thanks to digital transformations.

These new trends have helped improve the customer experience and allowed new-age insurtech companies to play and dominate in the market. To keep up, the existing players need to improve their tactics and adapt to new technologies, which can be challenging for many organizations.

Adopting digital transformation is not enough; maximizing conversions and converting your prospects to customers is the ultimate goal. Going digital can become overwhelming sometimes; companies might get thousands of visits on their websites or mobile apps but might not convert any of them into actual paying customers.

So, they have to focus on adopting digital transformation improving their customer experience and offering a personalized experience to increase their market potency.

The insurance industry is right to stick to its creative efforts and accept its market’s digital transformation. Now is the right time to seize all the opportunities for insurers to change their companies, how they work, and how they serve their customers.

This is the time for insurance companies to expand established partnerships and relationships to operate effectively and offer goods and services that comply with the customers’ expectations, drive progress and alleviate insurance companies’ pressure points. Insurers and insurtechs should reimagine what insurance can be and ensure that it meets the world’s needs.

These edge-cutting Insurance technology trends mentioned above bring in a fundamental transformation in the marketing and working of insurance companies. The insurance industry’s future is tailored policies, high connectivity, quick transactions, and constant information flow.

IoT development is a tech solution for insurance. It can enhance customer experience and identify fraudulent claims.

AI can automate the entire insurance process, handling everything from applications to claim settlements without human involvement.

The incorporation of technology in the insurance sector is enhancing efficiency, transparency, and, above all, adopting a more customer-centric approach.

We worked with Mindbowser on a design sprint, and their team did an awesome job. They really helped us shape the look and feel of our web app and gave us a clean, thoughtful design that our build team could...

The team at Mindbowser was highly professional, patient, and collaborative throughout our engagement. They struck the right balance between offering guidance and taking direction, which made the development process smooth. Although our project wasn’t related to healthcare, we clearly benefited...

Founder, Texas Ranch Security

Mindbowser played a crucial role in helping us bring everything together into a unified, cohesive product. Their commitment to industry-standard coding practices made an enormous difference, allowing developers to seamlessly transition in and out of the project without any confusion....

CEO, MarketsAI

I'm thrilled to be partnering with Mindbowser on our journey with TravelRite. The collaboration has been exceptional, and I’m truly grateful for the dedication and expertise the team has brought to the development process. Their commitment to our mission is...

Founder & CEO, TravelRite

The Mindbowser team's professionalism consistently impressed me. Their commitment to quality shone through in every aspect of the project. They truly went the extra mile, ensuring they understood our needs perfectly and were always willing to invest the time to...

CTO, New Day Therapeutics

I collaborated with Mindbowser for several years on a complex SaaS platform project. They took over a partially completed project and successfully transformed it into a fully functional and robust platform. Throughout the entire process, the quality of their work...

President, E.B. Carlson

Mindbowser and team are professional, talented and very responsive. They got us through a challenging situation with our IOT product successfully. They will be our go to dev team going forward.

Founder, Cascada

Amazing team to work with. Very responsive and very skilled in both front and backend engineering. Looking forward to our next project together.

Co-Founder, Emerge

The team is great to work with. Very professional, on task, and efficient.

Founder, PeriopMD

I can not express enough how pleased we are with the whole team. From the first call and meeting, they took our vision and ran with it. Communication was easy and everyone was flexible to our schedule. I’m excited to...

Founder, Seeke

We had very close go live timeline and Mindbowser team got us live a month before.

CEO, BuyNow WorldWide

If you want a team of great developers, I recommend them for the next project.

Founder, Teach Reach

Mindbowser built both iOS and Android apps for Mindworks, that have stood the test of time. 5 years later they still function quite beautifully. Their team always met their objectives and I'm very happy with the end result. Thank you!

Founder, Mindworks

Mindbowser has delivered a much better quality product than our previous tech vendors. Our product is stable and passed Well Architected Framework Review from AWS.

CEO, PurpleAnt

I am happy to share that we got USD 10k in cloud credits courtesy of our friends at Mindbowser. Thank you Pravin and Ayush, this means a lot to us.

CTO, Shortlist

Mindbowser is one of the reasons that our app is successful. These guys have been a great team.

Founder & CEO, MangoMirror

Kudos for all your hard work and diligence on the Telehealth platform project. You made it possible.

CEO, ThriveHealth

Mindbowser helped us build an awesome iOS app to bring balance to people’s lives.

CEO, SMILINGMIND

They were a very responsive team! Extremely easy to communicate and work with!

Founder & CEO, TotTech

We’ve had very little-to-no hiccups at all—it’s been a really pleasurable experience.

Co-Founder, TEAM8s

Mindbowser was very helpful with explaining the development process and started quickly on the project.

Executive Director of Product Development, Innovation Lab

The greatest benefit we got from Mindbowser is the expertise. Their team has developed apps in all different industries with all types of social proofs.

Co-Founder, Vesica

Mindbowser is professional, efficient and thorough.

Consultant, XPRIZE

Very committed, they create beautiful apps and are very benevolent. They have brilliant Ideas.

Founder, S.T.A.R.S of Wellness

Mindbowser was great; they listened to us a lot and helped us hone in on the actual idea of the app. They had put together fantastic wireframes for us.

Co-Founder, Flat Earth

Ayush was responsive and paired me with the best team member possible, to complete my complex vision and project. Could not be happier.

Founder, Child Life On Call

The team from Mindbowser stayed on task, asked the right questions, and completed the required tasks in a timely fashion! Strong work team!

CEO, SDOH2Health LLC

Mindbowser was easy to work with and hit the ground running, immediately feeling like part of our team.

CEO, Stealth Startup

Mindbowser was an excellent partner in developing my fitness app. They were patient, attentive, & understood my business needs. The end product exceeded my expectations. Thrilled to share it globally.

Owner, Phalanx

Mindbowser's expertise in tech, process & mobile development made them our choice for our app. The team was dedicated to the process & delivered high-quality features on time. They also gave valuable industry advice. Highly recommend them for app development...

Co-Founder, Fox&Fork