In today’s times, startups, fueled by visionary entrepreneurs eager to transform ideas into reality, stand as shining examples of innovation and play a pivotal role in shaping the future of different industries and economies. At their core, startups embody the spirit of innovation and the courage to challenge existing as well as future problems. Fueled by the desire to solve these problems and supported by startup funding, startups emerge as catalysts for change, introducing disruptive solutions that redefine markets and consumer experiences.

While the spirit of entrepreneurship is boundless, the practicalities of bringing ideas to reality often hinge on financial support. Herein lies the critical need for funding. Whether in the form of seed capital, venture funding, or strategic investments, securing financial backing is often the lifeblood of startups. It provides the resources necessary for research, development, market-entry, and scaling operations.

Against this backdrop, recent discussions in the startup ecosystem have centered around navigating funding challenges in a tightening market. In a recent event organized by StartupGrind and Mindbowser, titled “Funding Your Startup in a Tightening Market”, industry experts gathered to dissect the strategies and considerations essential for startups grappling with the evolving financial landscape.

In this blog, we will discuss the details regarding startup funding, startup complexities, entrepreneurship, and the indispensable need for funding. We delve into the wisdom shared during the recent event, exploring strategic considerations, bootstrapping tactics, and the art of effective pitching. Join us as we navigate the contours of entrepreneurial endeavors, seeking to understand how startups can not only survive but thrive in the face of financial challenges.

The Moderator for this discussion Manisha Khadge, brought a wealth of experience in marketing leadership to our event. As the Chief Marketing Officer at Mindbowser Inc., she successfully navigated the complexities of the digital age. Her insights served as a guiding force during our discussion on startup fundraising, bootstrapping, and effective pitching strategies.

Rajesh Kalane, Co-founder of HatchFast, brought over 13 years of expertise in transforming data into actionable insights. With a mission to revolutionize Functional Test Automation, Rajesh’s practical experience in the startup landscape provided valuable insights. HatchFast, under Rajesh’s leadership, continues to innovate, simplifying the process and boosting QA team productivity in startup fundraising.

Nitish Rai, Founder and CEO of FreightFox, remains committed to addressing customer challenges in the logistics sector. His dedication to crafting innovative solutions in the Indian manufacturing industry made Nitish a valuable voice in our discussion on startup fundraising. FreightFox continues to thrive under Nitish’s leadership, offering state-of-the-art logistics operations and orchestration solutions.

Aditya Kale is recognized as an expert in warehousing and supply chain management. His proven track record and commitment to industry innovation made Aditya a valuable contributor to our exploration of startup fundraising. Airattix Storage, led by Aditya, remains at the forefront of industry advancements, showcasing a steadfast commitment to excellence.

Aditya Oza is passionately devoted to creating a lasting brand presence in India. With a robust industry network and strategic acumen, Aditya’s experience spanned startups to Fortune 500 companies, offering a diverse perspective on our discussion of startup fundraising. EMotorad, guided by Aditya’s leadership, continues to grow, contributing to the dynamic landscape of electric mobility.

Related read: Trying To Get Funded? Here Is What Not To Do

Let us delve deeper into the key questions and their solutions discussed in the session➡️

Manisha set the stage for the conversation with warm greetings, creating an atmosphere of collaboration. Her initial intriguing question acted as a catalyst, steering the dialogue toward the heart of the matter of startup fundraising.

Embarking on a startup journey and seeking funding beyond traditional venture capital channels opens doors to diverse financial avenues. The panelists shared valuable insights about other options rather than approaching conventional venture capital funding. Some of these options include incubators and accelerators. Our panelists discussed these options more deeply.

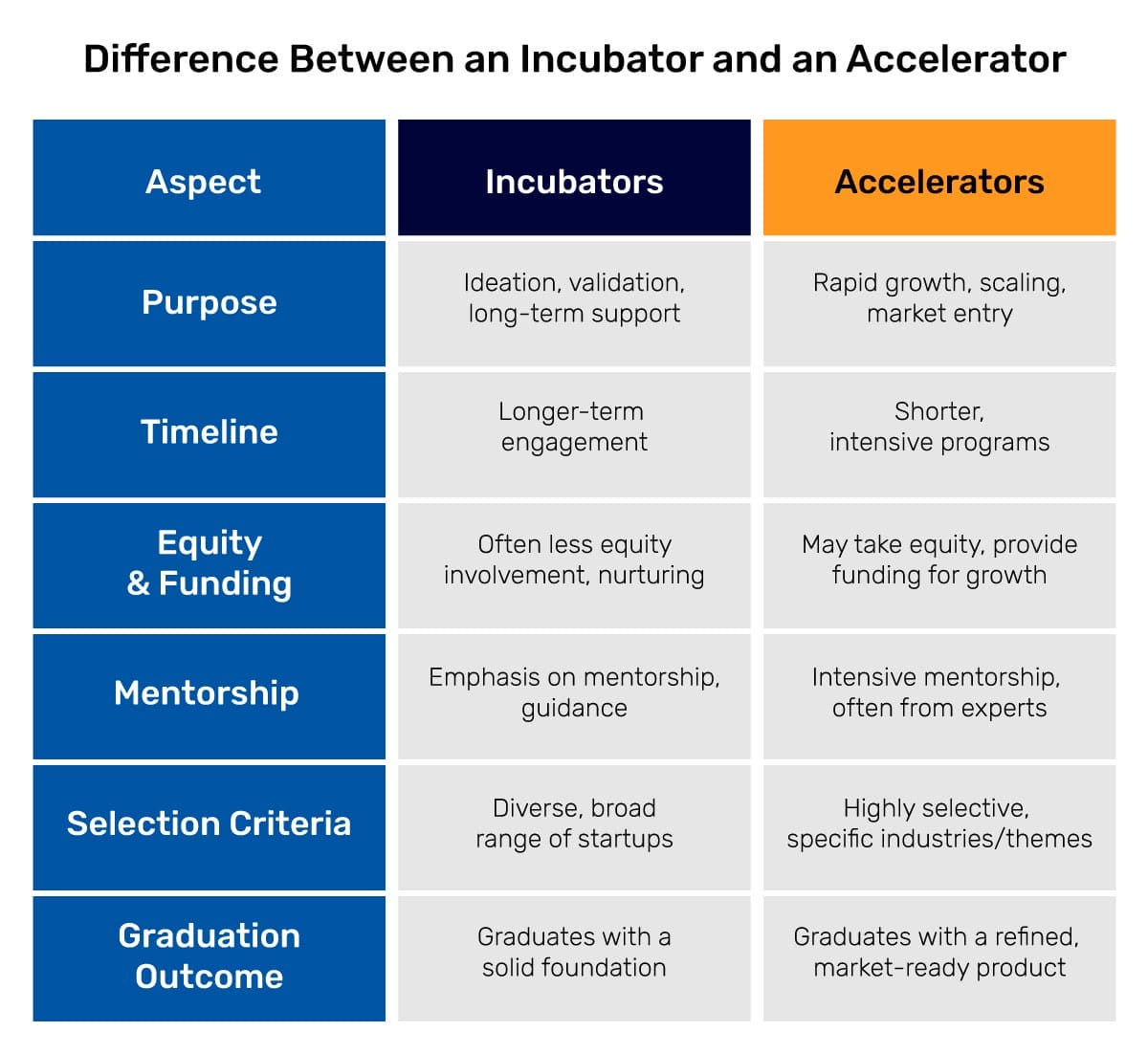

The session began with differentiating between incubators and accelerators➡️

Nitish Rai emphasized being acutely aware of the gaps in one’s entrepreneurial skill set. These gaps may include a lack of industry knowledge, limited networks, or financial constraints. By recognizing these limitations, entrepreneurs can make informed decisions about whether the structured support of an incubator or an accelerator aligns with their needs.

He also mentioned that “Incubators provide essential support and nurturing to help your startup funding grow and develop, while accelerators focus on rapidly advancing your progress and getting it to market faster. This powerful insight encapsulates the fundamental roles of these entities in the journey: incubators provide foundational support for ideation and evolution, while accelerators propel rapid growth and market viability. Entrepreneurs can leverage this wisdom to strategically navigate the startup funding ecosystem.

FreightFox, led by Nitish Rai, aligned with a global sustainability-focused accelerator featuring industry leaders like Unilever and Coca-Cola. Using the ULIP solution, Rai strategically engaged to showcase his sustainability mission, prioritizing visibility over extensive resources. This reflects Rai’s understanding of the transformative impact strategic partnerships with global leaders can have on a startup’s mission.

Aditya Oza, CMO & Co-Founder at EMotorad, provided insights into the entrepreneurial journey, emphasizing the significance of taking bold risks in building successful businesses. Aditya stressed the importance of testing ideas at each stage of funding, outlining the utilization of funds for crucial areas like Research and Development (R&D). His experience underscores the entrepreneurial journey’s dynamic nature, marked by strategic risk-taking and adaptability to achieve long-term success.

Rajesh Kalane shared valuable insights on startup funding strategies, emphasizing the importance of aligning with specific goals, especially after establishing a Minimum Viable Product (MVP). He recommended exploring Venture Capitalists (VCs) once the startup has a solid foundation. Nitish added to this by comparing cash flow to oxygen for startups, stressing its crucial role in sustaining business operations.

He illustrated this point with an analogy to live theater, highlighting the need for tailored approaches in different situations. Nitish cautioned early-stage startups against rushing to VCs, emphasizing the significance of finding ecosystem members who offer value beyond startup funding financial support. Communication with investors, especially during pre-seed rounds, was deemed crucial, with an emphasis on aligning visions.

Bootstrapping is a method of financing a startup funding or small business where the entrepreneur relies on personal savings, revenue generated by the business, and a lean, cost-effective approach instead of seeking external funding from investors or loans. In essence, it involves building and growing a business with minimal external capital, allowing the founder to maintain control over the company and its decision-making processes.

In response to Manisha’s query about the early stages of startups and the viability of bootstrapping, Nitish Rai shared a holistic perspective, emphasizing that funding should be viewed as a journey with a purpose rather than the primary objective. Nitish advised startups to be aware of their DNA, considering factors like revenue generation and the type of market they venture into.

Rajesh Kalane added that bootstrapping is particularly feasible for ventures like software development, stressing its importance as long as there’s a clear pathway and consistent revenue.

Aditya Kale shared his experience of bootstrapping for the initial two years, managing revenue judiciously through multitasking within the core team. Aditya Oza dispelled the stigma around funding, asserting that bootstrapped companies deserve equal appreciation for their success, even at smaller scales. Aditya Kale and Aditya Ojha emphasized the significance of making solid plans, cost-cutting, and facing challenges regardless of whether a startup is bootstrapped or funded.

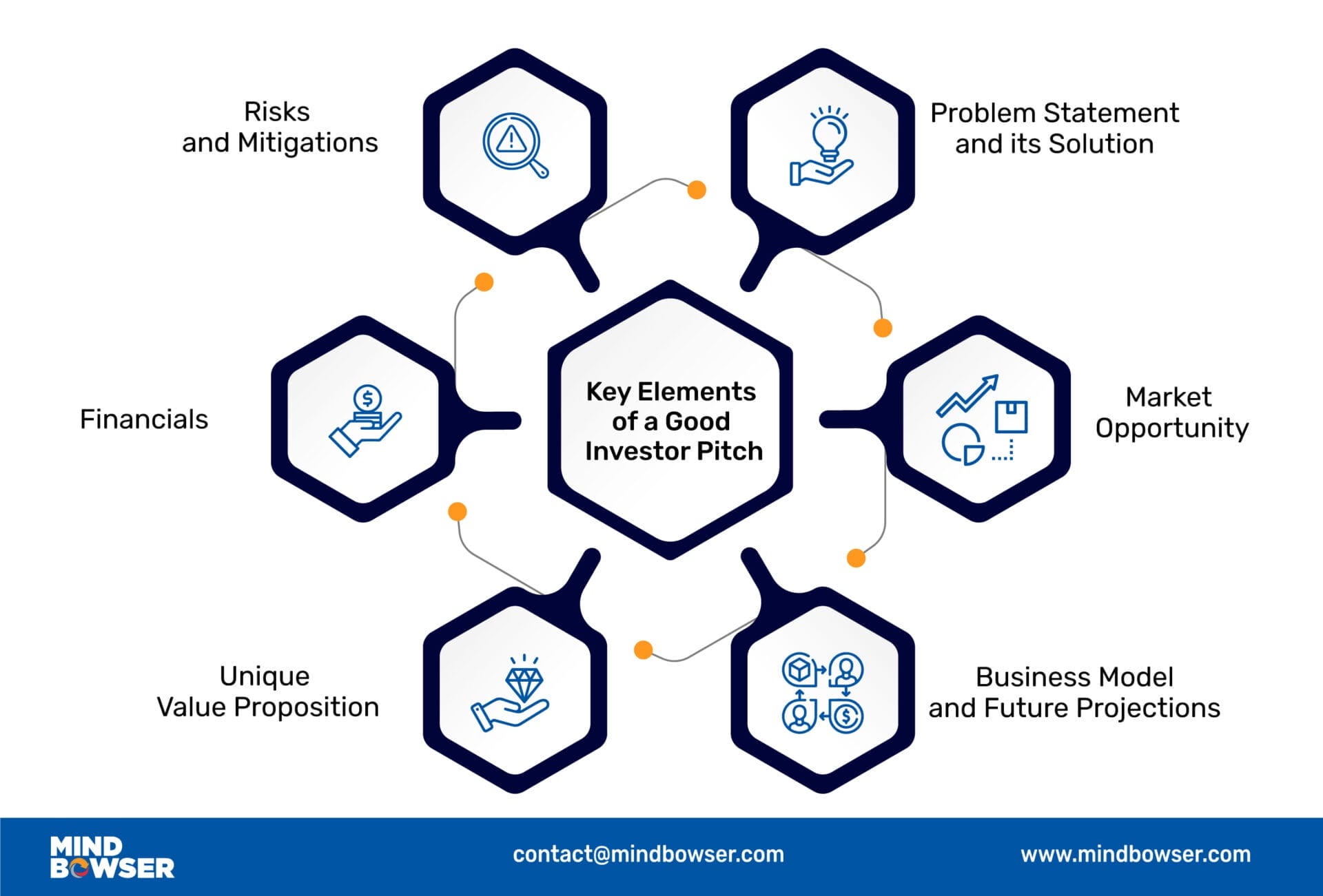

The skillful and strategic presentation of a business idea or project to potential investors, partners, or stakeholders is a crucial aspect of the entrepreneurial journey, where founders aim to effectively communicate the value proposition, unique selling points, and growth potential of their venture concisely and compellingly. The startup funding journey of the startup begins with the pitch to investors.

In response to Manisha’s inquiry about how to engage with investors and perfect the art of pitching, Aditya Ojha shared valuable insights, emphasizing the significance of effective storytelling. He highlighted the tactical nature of pitching, underscoring the importance of tailoring the pitch to the specific investor’s background and interests.

According to Aditya, creating a relatable narrative fosters a connection that can positively impact startup funding. Insights, he stressed, play a pivotal role in pitches, and the way the story is narrated is crucial. Aditya acknowledged that the first pitch may not be perfect, but each iteration is a learning opportunity. Using the example of saying that “by the 18th pitch, your pitch will be perfect,” he conveyed the iterative nature of refining and improving startup funding pitches through experience and continuous learning.

Aditya Kale expanded on the intricacies of making a successful pitch, emphasizing that during the initial pitch, investors closely examine the idea, the founder, the current state of the startup, and projections for the upcoming years. He highlighted the importance of direct communication with investors, emphasizing that being relatable makes the startup funding process smoother.

Aditya emphasized the importance of realistic projections and having a clear understanding of the funds required for the company’s growth. He highlighted the need to effectively communicate and explain fund spending, ensuring transparency and trust in the funding journey.

Nitish emphasized the crucial role of understanding customer needs and effectively addressing the problems in the startup funding journey during pitching. He stressed the importance of presenting these aspects properly to build trust with investors. Nitish highlighted the need to develop expertise in the field, emphasizing that while investors may not analyze the entire startup in one pitch, they assess the founder’s passion and the product’s aim.

He advised founders to continually improve their pitching practices, focusing on self-image, concise presentation, and relevance in delivering essential points to capture investor attention without overwhelming unnecessary details.

Rajesh Kalane added to this by emphasizing the necessity of communicating one’s beliefs passionately to investors. He urged founders to address all issues transparently and present a comprehensive pitch that avoids false promises, sticking to the basics. Aditya Ojha acknowledged the difficulty in pitching to investors who may not be the startup’s end customers, emphasizing the challenge of making the business relatable to venture capitalists who might not directly connect with the startup funding product or service.

Collectively, their insights underscored the importance of effective communication, transparency, and passion in delivering impactful pitches to potential investors.

The session moved towards a conclusion with a member of the audience seeking advice on maintaining a bootstrapped startup while managing personal finances and whether this situation leads to the need for external startup funding. Nitish responded by stressing the importance of having at least 18 months’ worth of expenses if one is committed to working on their startup. He highlighted the significance of having a financial cushion but also noted that the absence of funds should not hinder someone from starting their entrepreneurial journey.

Nitish encapsulated this perspective with a powerful statement, saying, “No runway is a rough runway, but no runway is also a runway,” underlining the idea that determination and resourcefulness can propel a startup forward, even in challenging financial circumstances.

During the Q&A session, the panelists also discussed the significance of timing in the startup world, highlighting that seizing the right opportunities at the right moment can be a crucial factor in success.

The insightful discussion on “Funding Your Startup in a Tightening Market” brought forth a wealth of knowledge, encapsulating the essence of entrepreneurship, strategic startup funding, and the art of effective pitching. The panelists, led by the seasoned moderator Manisha Khadge, provided invaluable perspectives on navigating the complex landscape of startup funding, from alternative sources beyond traditional VC to the brilliance of bootstrapping and the intricacies of delivering a compelling pitch.

The stories shared by entrepreneurs like Nitish Rai, Aditya Kale, and others showcased the diversity of startup journeys, emphasizing the importance of adaptability, strategic decision-making, and a relentless commitment to innovation. The concluding message, echoing Nitish Rai’s powerful statement, reinforced the idea that determination and resourcefulness can serve as a runway for startups, even in challenging financial climates.

To know more about this event you can watch the entire recording of the insightful session on Startup Grind – Funding your startup in a tightening market.

As startups continue to grow, these insights serve as a compass for aspiring entrepreneurs, offering guidance on the multifaceted facets of securing startup funding, building resilient businesses, and mastering the art of storytelling to connect with investors. The entrepreneurial journey, as illuminated by the panelists, is not merely a pursuit of financial backing but a quest for impact, growth, and the transformation of bold ideas into lasting success.

Leave your competitors behind! Become an EPIC integration pro, and boost your team's efficiency.

Register Here

The Mindbowser team's professionalism consistently impressed me. Their commitment to quality shone through in every aspect of the project. They truly went the extra mile, ensuring they understood our needs perfectly and were always willing to invest the time to...

CTO, New Day Therapeutics

I collaborated with Mindbowser for several years on a complex SaaS platform project. They took over a partially completed project and successfully transformed it into a fully functional and robust platform. Throughout the entire process, the quality of their work...

President, E.B. Carlson

Mindbowser and team are professional, talented and very responsive. They got us through a challenging situation with our IOT product successfully. They will be our go to dev team going forward.

Founder, Cascada

Amazing team to work with. Very responsive and very skilled in both front and backend engineering. Looking forward to our next project together.

Co-Founder, Emerge

The team is great to work with. Very professional, on task, and efficient.

Founder, PeriopMD

I can not express enough how pleased we are with the whole team. From the first call and meeting, they took our vision and ran with it. Communication was easy and everyone was flexible to our schedule. I’m excited to...

Founder, Seeke

Mindbowser has truly been foundational in my journey from concept to design and onto that final launch phase.

CEO, KickSnap

We had very close go live timeline and Mindbowser team got us live a month before.

CEO, BuyNow WorldWide

If you want a team of great developers, I recommend them for the next project.

Founder, Teach Reach

Mindbowser built both iOS and Android apps for Mindworks, that have stood the test of time. 5 years later they still function quite beautifully. Their team always met their objectives and I'm very happy with the end result. Thank you!

Founder, Mindworks

Mindbowser has delivered a much better quality product than our previous tech vendors. Our product is stable and passed Well Architected Framework Review from AWS.

CEO, PurpleAnt

I am happy to share that we got USD 10k in cloud credits courtesy of our friends at Mindbowser. Thank you Pravin and Ayush, this means a lot to us.

CTO, Shortlist

Mindbowser is one of the reasons that our app is successful. These guys have been a great team.

Founder & CEO, MangoMirror

Kudos for all your hard work and diligence on the Telehealth platform project. You made it possible.

CEO, ThriveHealth

Mindbowser helped us build an awesome iOS app to bring balance to people’s lives.

CEO, SMILINGMIND

They were a very responsive team! Extremely easy to communicate and work with!

Founder & CEO, TotTech

We’ve had very little-to-no hiccups at all—it’s been a really pleasurable experience.

Co-Founder, TEAM8s

Mindbowser was very helpful with explaining the development process and started quickly on the project.

Executive Director of Product Development, Innovation Lab

The greatest benefit we got from Mindbowser is the expertise. Their team has developed apps in all different industries with all types of social proofs.

Co-Founder, Vesica

Mindbowser is professional, efficient and thorough.

Consultant, XPRIZE

Very committed, they create beautiful apps and are very benevolent. They have brilliant Ideas.

Founder, S.T.A.R.S of Wellness

Mindbowser was great; they listened to us a lot and helped us hone in on the actual idea of the app. They had put together fantastic wireframes for us.

Co-Founder, Flat Earth

Ayush was responsive and paired me with the best team member possible, to complete my complex vision and project. Could not be happier.

Founder, Child Life On Call

The team from Mindbowser stayed on task, asked the right questions, and completed the required tasks in a timely fashion! Strong work team!

CEO, SDOH2Health LLC

Mindbowser was easy to work with and hit the ground running, immediately feeling like part of our team.

CEO, Stealth Startup

Mindbowser was an excellent partner in developing my fitness app. They were patient, attentive, & understood my business needs. The end product exceeded my expectations. Thrilled to share it globally.

Owner, Phalanx

Mindbowser's expertise in tech, process & mobile development made them our choice for our app. The team was dedicated to the process & delivered high-quality features on time. They also gave valuable industry advice. Highly recommend them for app development...

Co-Founder, Fox&Fork