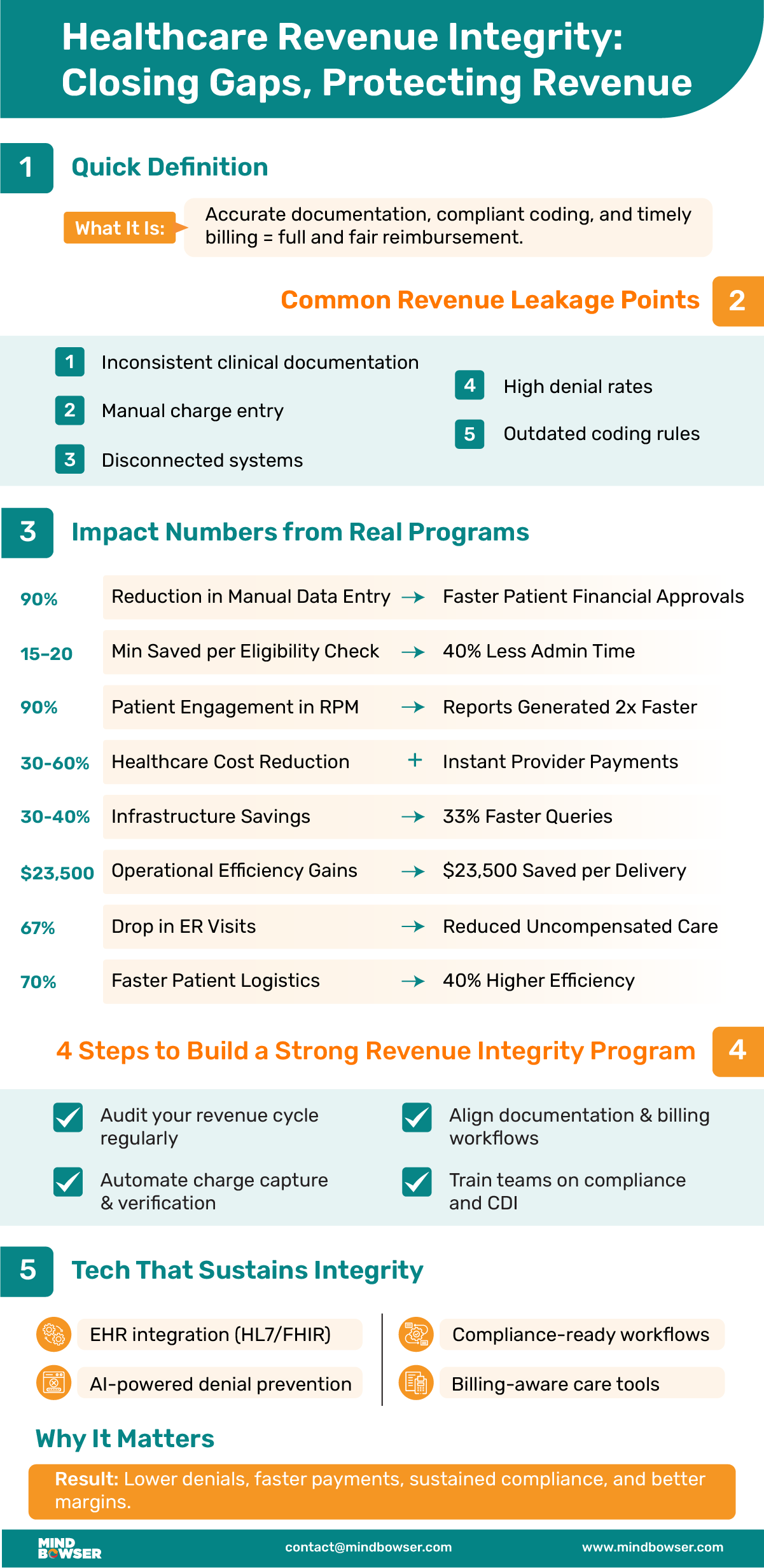

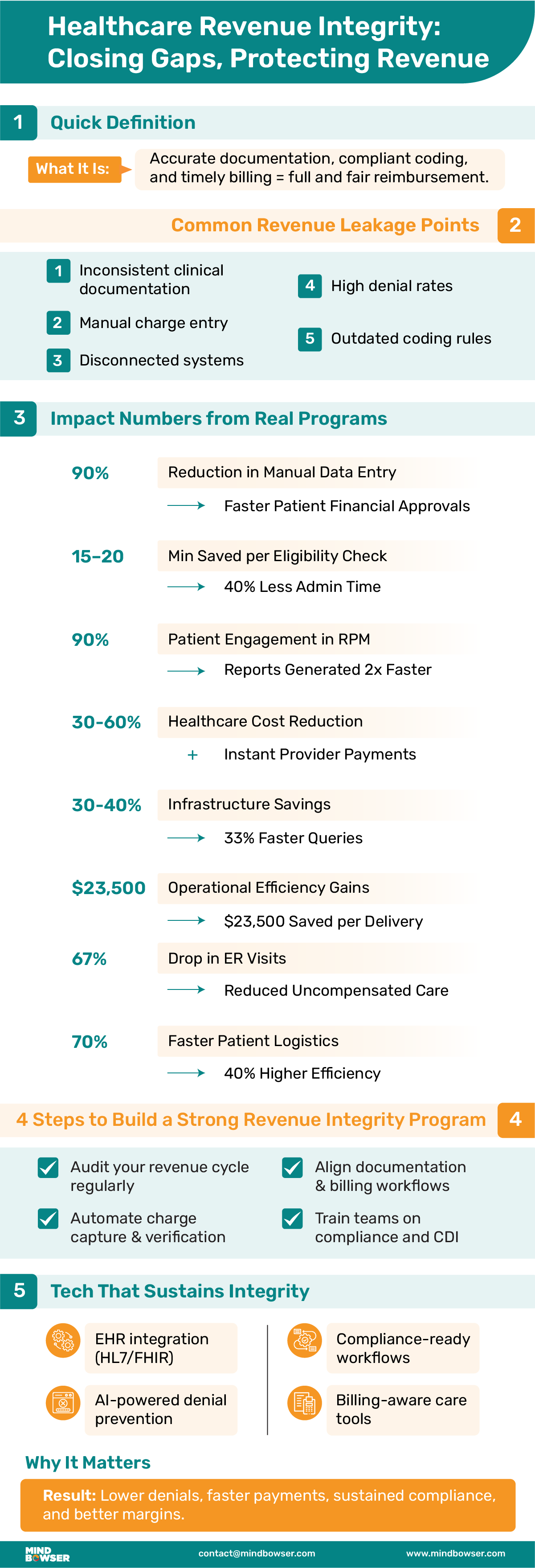

• Definition: Healthcare revenue integrity refers to ensuring that every service is accurately documented, coded, and billed for proper reimbursement and compliance.

• Why it matters: Prevents revenue leakage, reduces denials, and safeguards against compliance risks.

• Key challenges include: Inconsistent documentation, manual charge entry, disconnected systems, high denial rates, frequent coding updates, a lack of trained staff, inadequate audit readiness, and reactive monitoring.

• Building a program:

• Technology’s role: EHR integrations, AI-based denial prevention, compliance-ready workflows, and real-time dashboards keep programs efficient and sustainable.

Imagine delivering exceptional care to a patient in critical condition. The clinical team acts quickly, procedures are performed flawlessly, and the patient is discharged in stable condition. Weeks later, the reimbursement for that care arrives, but it’s far less than expected. The reason isn’t related to the quality of treatment. It comes down to coding errors, incomplete documentation, and a few missed charges along the way.

This type of silent revenue leakage occurs daily across the healthcare system. It chips away at margins, slows cash flow, and increases administrative strain. For providers already working under tighter budgets and shifting payment models, these small oversights add up to significant losses over time.

Healthcare revenue integrity serves as a safeguard against this problem. At its core, it means ensuring that every service provided is accurately documented, correctly coded, billed promptly, and reimbursed in full. When this process functions as intended, it protects revenue, supports compliance, and minimizes costly rework.

The urgency is growing. Denials are on the rise, payers are enforcing more complex rules, and operational costs continue to climb. In this environment, a strong revenue integrity program is no longer a nice-to-have; it’s a necessary part of financial stability and long-term sustainability for healthcare organizations.

Even with the best intentions, many healthcare organizations struggle to protect every dollar they earn. Operational complexity, manual processes, and constant regulatory changes create multiple points where revenue can leak out of the cycle. Below are the most common challenges and their corresponding solutions.

Clinicians often rely on free-text notes or shorthand entries that lack the level of detail coders need. This makes it difficult to determine the exact services provided and assign accurate codes.

Implement standardized templates and real-time prompts within the EHR to guide providers on required fields and details. Mindbowser has helped a clinical platform create configurable test guidelines and structured data capture, reducing ambiguity and improving coding accuracy.

Many revenue cycles still depend on staff manually entering charges from paper notes or separate spreadsheets.

Automated charge reconciliation tools integrated with clinical workflows can capture services as they are provided. One remote monitoring platform employed this approach to track CPT codes in real-time, thereby reducing billing delays and enhancing claim accuracy.

Many leaders now see technology not as a cost, but as a revenue contributor. As Michael Archuleta, CIO at Mt. San Rafael Hospital and Clinics, noted in our podcast,

“Hospitals and clinics should operate as “digital companies that deliver healthcare services” and view digital transformation as essential to financial sustainability.”

When EHR, practice management, and billing software operate independently, critical information is not always passed along accurately.

Integration workflows, such as HealthConnect CoPilot, utilize HL7 and FHIR standards to unify data exchange between systems, ensuring that charges, codes, and documentation remain consistent from the point of care to final billing.

Claims may be denied for a variety of reasons, but without a way to track and categorize these denials, patterns go unnoticed.

AI-based denial prevention systems, such as QConnect AI Suite, flag high-risk claims before submission and provide analytics to pinpoint recurring issues, enabling targeted staff training and process fixes.

CPT, ICD-10, and HCPCS codes are updated regularly, and payers often have their own requirements layered on top.

Embedded compliance monitoring within coding workflows helps ensure that submissions remain current. For example, we automated HIPAA and SOC 2 checks reduced compliance work by 85%, freeing staff to focus on patient-facing tasks.

Many organizations assign coding and billing tasks to already overburdened administrative staff without dedicated revenue integrity training.

Adding trained revenue integrity specialists or augmenting teams with healthcare domain expertise improves coding accuracy, reduces backlogs, and shortens turnaround times. A credential and CME tracking platform scaled quickly by supplementing its internal team with Mindbowser’s specialized healthcare technology support, enabling faster growth without sacrificing accuracy.

Without automated checks, errors may only be discovered during payer audits or after a claim is denied.

Automated pre-bill audits, audit logs, and compliance dashboards can be integrated directly into workflows, enabling the detection and correction of issues before submission.

Many revenue cycle teams only analyze performance after a significant drop in revenue or an uptick in denials.

Role-based dashboards displaying claims, charges, and denials in real-time provide finance and compliance teams with immediate insight, enabling them to take proactive action.

Improving revenue integrity is not about one single change. It requires a coordinated approach that touches documentation, coding, compliance, technology, and staff training. The most effective programs are designed to integrate seamlessly into daily operations, rather than adding another layer of administrative burden.

Automating the exchange of patient data between financial assistance systems and the EHR can prevent delays that lead to revenue loss. We helped a client integrate a patient assistance platform with the EHR through HL7 and FHIR, eliminating manual uploads, reducing manual data entry by 90%, and enabling the instant retrieval of patient records, thereby accelerating financial approvals and minimizing administrative errors.

By following these steps, organizations create a revenue integrity framework that is proactive rather than reactive. The goal is to protect existing revenue to build processes that adapt easily to regulatory changes, payer requirements, and evolving care models.

Related read: A Guide to Healthcare Revenue Cycle Management

A well-designed revenue integrity program lays the foundation, but technology is what keeps it running smoothly over time. Manual oversight alone can’t keep up with the complexity of payer requirements, coding updates, and compliance checks. Sustainable revenue integrity depends on solutions that integrate with daily workflows, reduce human error, and provide real-time insight.

Embedding CPT tracking directly into care manager portals ensures all reimbursable services are captured. In one remote monitoring program, this approach helped maintain compliance, improved billing accuracy, and contributed to a 90% patient engagement rate, while report generation time for administrators was cut in half.

Technology isn’t replacing the need for skilled staff in revenue integrity; it’s amplifying their impact. With the right tools, teams can spend less time chasing errors and more time preventing them, keeping revenue secure and compliance intact as the industry evolves.

Launching a revenue integrity program is only the first step. To maintain effectiveness, organizations require ongoing oversight, regular updates, and a culture that views revenue integrity as a shared responsibility. These best practices help maintain performance over the long term.

Sustaining revenue integrity is not a one-time project but an ongoing process that adapts as the healthcare environment changes. Organizations that invest in consistent monitoring, cross-team communication, and timely training are better positioned to maintain stable cash flow, reduce denials, and remain compliant year after year.

Many healthcare organizations recognize that they have revenue leakage but struggle to pinpoint where it occurs or how to address it without overburdening their teams. Mindbowser brings a combination of healthcare domain expertise, custom technology solutions, and proven integration capabilities to close those gaps.

We specialize in EHR, practice management, and billing system integrations using HL7 and FHIR standards. Our HealthConnect CoPilot workflow ensures that clinical documentation, coding, and billing data flow seamlessly across systems, reducing missed charges and the need for manual reconciliation.

Our solutions are designed to meet HIPAA, SOC 2, and CMS requirements. Automated audit trails, pre-bill checks, and real-time compliance monitoring keep your organization audit-ready without adding extra steps to your team’s workflow.

We help implement automated charge reconciliation at the point of care and deploy AI-driven denial prevention tools, such as QConnect AI Suite, to flag high-risk claims before submission. This combination improves first-pass yield and reduces rework.

Rather than forcing you to adapt to rigid software, we develop custom dashboards, coding prompts, and role-based views that align with how your teams already work. This shortens adoption time and increases user engagement.

When resources are stretched, we provide experienced healthcare technology professionals and domain specialists who can work alongside your staff. From CDI training to coding support, we can help you scale without sacrificing accuracy.

From reducing denial rates for remote monitoring programs to enabling structured documentation in specialty clinics, our solutions have helped healthcare providers protect revenue, maintain compliance, and improve operational efficiency.

Revenue integrity is more than a financial safeguard; it’s a bridge between the clinical work done for patients and the organization’s financial health. Without it, even the best care can result in underpayment, delayed cash flow, or costly compliance issues.

The most effective programs combine:

With the right strategy, healthcare organizations can significantly lower denial rates, improve claim turnaround times, and remain audit-ready at all times.

Discover how our EHR integration solutions, AI-powered compliance tools, and healthcare accelerators can strengthen your revenue integrity program. Talk to our team to see how we can help you protect revenue while keeping compliance front and center.

Revenue integrity in healthcare is the coordinated process of ensuring that every service delivered to a patient is accurately documented, coded, and billed so the provider receives the correct reimbursement. It blends clinical accuracy, compliance, and financial oversight to prevent lost revenue and reduce audit risk.

A revenue integrity program prevents revenue leakage by:

Streamlining communication between clinical and billing teams

This process protects an organization’s bottom line while supporting timely cash flow.

The term refers to the broader practice of aligning clinical data, coding, and claims submission processes for accuracy, compliance, and efficiency. It covers everything from how a physician documents a visit to how that service is coded, to the final claim sent to the payer. In a well-run system, all three align perfectly, minimizing risk and maximizing reimbursement.

We worked with Mindbowser on a design sprint, and their team did an awesome job. They really helped us shape the look and feel of our web app and gave us a clean, thoughtful design that our build team could...

The team at Mindbowser was highly professional, patient, and collaborative throughout our engagement. They struck the right balance between offering guidance and taking direction, which made the development process smooth. Although our project wasn’t related to healthcare, we clearly benefited...

Founder, Texas Ranch Security

Mindbowser played a crucial role in helping us bring everything together into a unified, cohesive product. Their commitment to industry-standard coding practices made an enormous difference, allowing developers to seamlessly transition in and out of the project without any confusion....

CEO, MarketsAI

I'm thrilled to be partnering with Mindbowser on our journey with TravelRite. The collaboration has been exceptional, and I’m truly grateful for the dedication and expertise the team has brought to the development process. Their commitment to our mission is...

Founder & CEO, TravelRite

The Mindbowser team's professionalism consistently impressed me. Their commitment to quality shone through in every aspect of the project. They truly went the extra mile, ensuring they understood our needs perfectly and were always willing to invest the time to...

CTO, New Day Therapeutics

I collaborated with Mindbowser for several years on a complex SaaS platform project. They took over a partially completed project and successfully transformed it into a fully functional and robust platform. Throughout the entire process, the quality of their work...

President, E.B. Carlson

Mindbowser and team are professional, talented and very responsive. They got us through a challenging situation with our IOT product successfully. They will be our go to dev team going forward.

Founder, Cascada

Amazing team to work with. Very responsive and very skilled in both front and backend engineering. Looking forward to our next project together.

Co-Founder, Emerge

The team is great to work with. Very professional, on task, and efficient.

Founder, PeriopMD

I can not express enough how pleased we are with the whole team. From the first call and meeting, they took our vision and ran with it. Communication was easy and everyone was flexible to our schedule. I’m excited to...

Founder, Seeke

We had very close go live timeline and Mindbowser team got us live a month before.

CEO, BuyNow WorldWide

Mindbowser brought in a team of skilled developers who were easy to work with and deeply committed to the project. If you're looking for reliable, high-quality development support, I’d absolutely recommend them.

Founder, Teach Reach

Mindbowser built both iOS and Android apps for Mindworks, that have stood the test of time. 5 years later they still function quite beautifully. Their team always met their objectives and I'm very happy with the end result. Thank you!

Founder, Mindworks

Mindbowser has delivered a much better quality product than our previous tech vendors. Our product is stable and passed Well Architected Framework Review from AWS.

CEO, PurpleAnt

I am happy to share that we got USD 10k in cloud credits courtesy of our friends at Mindbowser. Thank you Pravin and Ayush, this means a lot to us.

CTO, Shortlist

Mindbowser is one of the reasons that our app is successful. These guys have been a great team.

Founder & CEO, MangoMirror

Kudos for all your hard work and diligence on the Telehealth platform project. You made it possible.

CEO, ThriveHealth

Mindbowser helped us build an awesome iOS app to bring balance to people’s lives.

CEO, SMILINGMIND

They were a very responsive team! Extremely easy to communicate and work with!

Founder & CEO, TotTech

We’ve had very little-to-no hiccups at all—it’s been a really pleasurable experience.

Co-Founder, TEAM8s

Mindbowser was very helpful with explaining the development process and started quickly on the project.

Executive Director of Product Development, Innovation Lab

The greatest benefit we got from Mindbowser is the expertise. Their team has developed apps in all different industries with all types of social proofs.

Co-Founder, Vesica

Mindbowser is professional, efficient and thorough.

Consultant, XPRIZE

Very committed, they create beautiful apps and are very benevolent. They have brilliant Ideas.

Founder, S.T.A.R.S of Wellness

Mindbowser was great; they listened to us a lot and helped us hone in on the actual idea of the app. They had put together fantastic wireframes for us.

Co-Founder, Flat Earth

Mindbowser was incredibly responsive and understood exactly what I needed. They matched me with the perfect team member who not only grasped my vision but executed it flawlessly. The entire experience felt collaborative, efficient, and truly aligned with my goals.

Founder, Child Life On Call

The team from Mindbowser stayed on task, asked the right questions, and completed the required tasks in a timely fashion! Strong work team!

CEO, SDOH2Health LLC

Mindbowser was easy to work with and hit the ground running, immediately feeling like part of our team.

CEO, Stealth Startup

Mindbowser was an excellent partner in developing my fitness app. They were patient, attentive, & understood my business needs. The end product exceeded my expectations. Thrilled to share it globally.

Owner, Phalanx

Mindbowser's expertise in tech, process & mobile development made them our choice for our app. The team was dedicated to the process & delivered high-quality features on time. They also gave valuable industry advice. Highly recommend them for app development...

Co-Founder, Fox&Fork