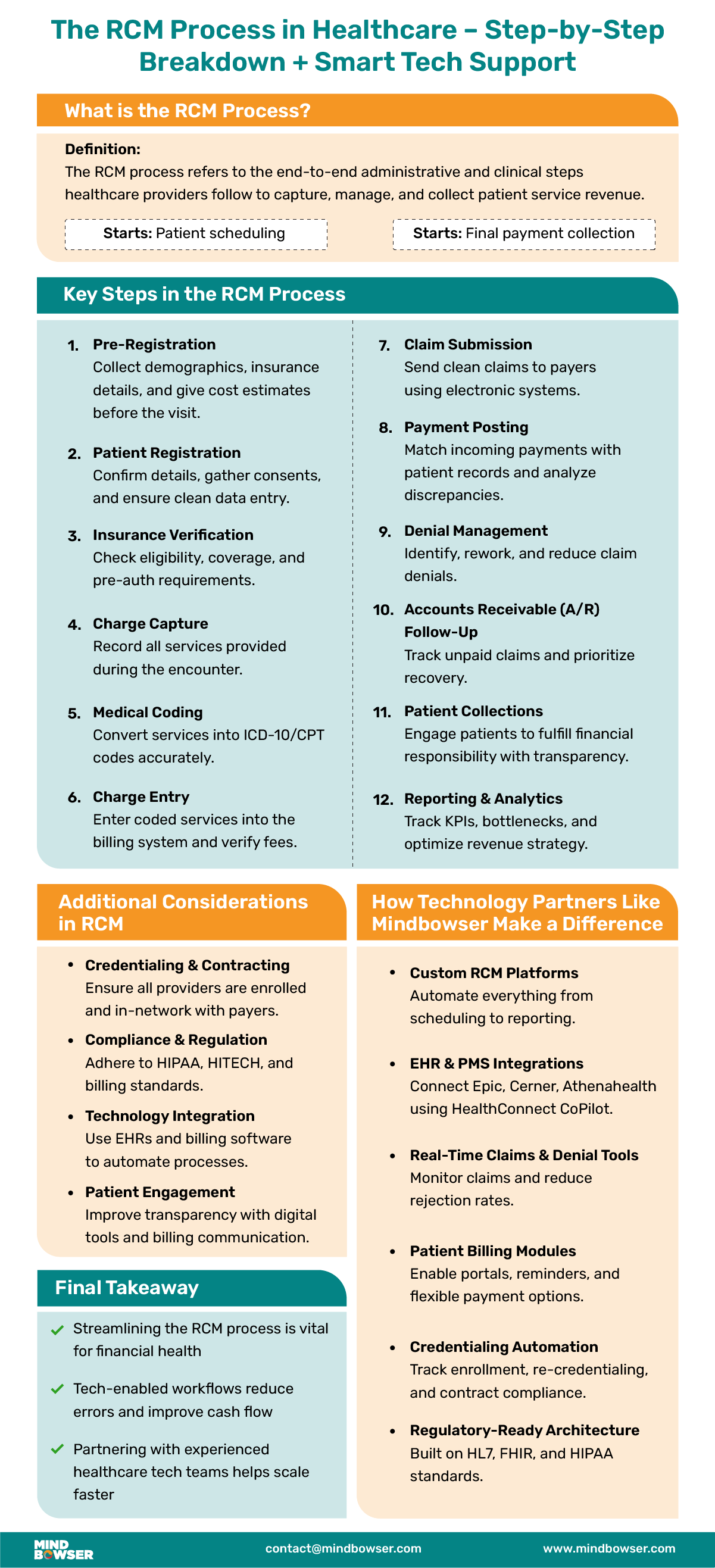

Revenue Cycle Management (RCM) is the financial backbone of healthcare operations, encompassing every step from patient scheduling to final payment. It aligns administrative workflows with clinical services to ensure healthcare providers get paid accurately and on time for their care. A well-structured RCM process bridges the gap between patient encounters and payment, vital to financial sustainability.

Efficient RCM does more than just manage billing—it streamlines operations, reduces claim denials, and boosts revenue predictability. It touches multiple departments, from front-desk staff and medical coders to billing teams and compliance officers. Any breakdown or delay within the cycle can lead to denied claims, cash flow disruptions, or regulatory risks. That’s why understanding each step in the RCM process is essential for any provider aiming to run a financially healthy practice.

This guide outlines the full RCM process, step by step, based on insights from top healthcare and medical billing sources. Whether you’re managing a small clinic or a multi-specialty hospital, knowing how each part of the cycle works—and how to optimize it—can make a measurable difference in your revenue outcomes.

The RCM or Revenue Cycle Management process is a structured workflow that healthcare providers follow to manage the financial side of patient care. It includes all the steps necessary to track revenue from when a patient books an appointment until the final payment is received and recorded.

This cycle begins with pre-visit tasks like patient registration and insurance verification. It continues through clinical documentation, coding, and billing, and ends with claims submission, payment posting, and collections. Accurate data handling and timely communication with payers and patients are critical at every stage.

A well-managed RCM process ensures providers are paid correctly and promptly, supports compliance with healthcare regulations, and minimizes revenue leakage due to denied or delayed claims. It plays an important role in maintaining the financial health of any healthcare organization.

Related read: AI in Medical Coding: Building Intelligent Solutions for Faster & Accurate Billing

You need to think of the healthcare revenue cycle management process as the foundation of your organization’s financial stability. If you neglect it, even minor inefficiencies can snowball into denied claims, compliance risks, and shrinking margins. Hospitals already operate on thin margins, and a small increase in denials or delays can mean the difference between profitability and financial distress.

A well-structured RCM process allows you to collect revenue accurately, comply with payer and government regulations, and build trust with patients through transparent billing. Patients who understand their financial responsibilities and face fewer disputes are more likely to return and recommend your services. This makes RCM not just an administrative function but a strategic driver of growth.

Related read: Future of Healthcare Revenue Cycle Management

Patient pre-registration sets the groundwork for a smooth billing cycle. It involves collecting basic demographic details and insurance information before the appointment. Verifying insurance eligibility ensures the patient has active coverage and clarifies their benefits.

Providing an upfront cost estimate helps patients understand their financial responsibility, which improves transparency, boosts patient satisfaction, and minimizes payment delays. Pre-registration also allows providers to flag issues early, reducing claim denials later.

This step confirms and updates the details gathered during pre-registration when the patient arrives. It includes verifying contact details and insurance information and acquiring necessary consents for treatment and billing.

Proper registration reduces downstream errors and ensures clean claim submission. Ensuring accuracy at this stage prevents miscommunication, billing delays, or compliance issues, making it a crucial handoff from administrative intake to clinical care and financial processing.

Insurance verification is essential to confirm a patient’s coverage status and determine co-pays, deductibles, or non-covered services. This step also identifies if prior authorizations are needed for certain treatments or tests.

Clear communication of coverage details with patients prevents confusion and improves their financial preparedness. Timely and accurate verification ensures that providers don’t face surprises during claim submission and accelerates reimbursement.

Charge capture involves documenting all billable services rendered during the patient encounter. Accuracy here is critical—missing charges or misdocumented services directly affect revenue. Electronic systems and integrated EHR tools are typically used to streamline and standardize this process. Capturing complete and correct information at the point of care helps eliminate revenue leakage and ensures that no services go unbilled or underbilled.

Medical coding translates the clinical notes and documentation into standardized codes (such as ICD-10 and CPT) for billing purposes. Accurate coding is vital for correct reimbursement and compliance with payer policies.

Errors in coding can lead to claim rejections or audits. Staying current with coding updates ensures that billing aligns with the latest regulations and reimbursement models, safeguarding revenue and reputation.

Related read: What is Medical Coding Compliance and Why is it Crucial for Healthcare Providers?

In this step, coded services are entered into the billing system for claim creation. It includes assigning the correct fees based on payer-specific contracts and reviewing entries for consistency and completeness.

Even small errors in charge entry can result in underpayments or denials. Streamlining this process with automated tools and checks minimizes errors and helps maintain a smooth revenue cycle.

Claims are submitted electronically to insurance companies through clearinghouses or directly to payers. Submissions must meet specific formatting and timing guidelines for each payer.

Timely and accurate claim submission reduces the risk of rejections and accelerates reimbursement. Monitoring rejections and promptly correcting and resubmitting claims also form part of this critical function.

This stage involves recording payments received from insurance providers and patients. Payments are matched to their respective accounts, and any underpayments or denials are flagged for review.

Proper payment posting keeps accounts updated and gives visibility into cash flow. Discrepancies found here can trigger follow-ups or appeals, ensuring the provider receives the full amount owed.

When claims are denied, it’s essential to analyze the reasons, correct any errors, and resubmit them quickly. Denial management also involves identifying patterns that can be fixed upstream, like coding errors or missing documentation.

Proactive denial handling reduces lost revenue and improves first-pass claim acceptance rates over time, making it a vital performance indicator in RCM.

Related read: How We Help Build Scalable Healthcare Claims Management Software for Payers and Providers

Accounts receivable (A/R) follow-up monitors unpaid balances from insurers and patients. Staff may contact payers to resolve claim issues or patients regarding outstanding bills. Prioritizing accounts based on age or value ensures that efforts are focused where they can have the most financial impact. Effective A/R management keeps the cash flow healthy and reduces the number of accounts written off.

This step involves communicating clearly with patients about their balances and providing options like installment plans or discounts. Respecting patient rights and adhering to billing regulations is key here. A positive collections experience can support financial recovery and patient satisfaction, especially in an era of rising out-of-pocket expenses.

The final step focuses on generating financial and operational reports to evaluate the performance of the RCM process. Metrics like denial rates, days in A/R, and net collections provide insight into where improvements are needed. Data from this stage supports strategic decision-making, resource planning, and process optimization to drive long-term financial health.

Credentialing is a foundational step in the RCM process that verifies a provider’s qualifications and affiliations before they can bill insurance companies. Keeping payer contracts updated ensures accurate reimbursement based on negotiated terms.

Delays or errors in credentialing can result in claim denials or underpayments. Regularly reviewing contract terms and re-credentialing schedules helps maintain steady cash flow and ensures the provider remains in-network with insurers.

Healthcare providers must stay compliant with regulations like HIPAA, HITECH, and payer-specific policies. Non-compliance can lead to hefty fines, delayed claims, or reputational damage.

An effective RCM process includes regular training for staff, internal audits, and real-time policy updates to avoid violations. Adhering to these regulations ensures data security, improves patient trust, and keeps the organization aligned with both state and federal requirements.

Related read: Navigating the Regulatory Landscape: A Guide to Healthcare Compliance Regulations

Integrating advanced RCM software and EHR systems helps automate repetitive tasks like insurance verification, charge entry, and claims submission. This reduces manual errors, speeds up billing cycles, and improves data accuracy.

Real-time dashboards and analytics allow administrators to track revenue trends and identify bottlenecks. Using interoperable systems ensures smoother communication across departments and improves overall operational efficiency in the revenue cycle.

Related read: Top 5 EHR Integration Software Companies

Engaging patients in billing improves payment rates and reduces confusion. Clear communication about insurance coverage, co-pays, and out-of-pocket expenses builds transparency and trust.

Offering patient engagement tools like patient portals, cost estimators, and automated reminders helps patients stay informed and act promptly. Educated patients are more likely to meet their financial responsibilities, positively impacting cash flow and reducing billing disputes.

You must be ready to address the common challenges that undermine revenue cycle efficiency. Insurers are steadily reducing reimbursement rates, and prior authorization rules are stricter than ever. If you fail to manage these requirements, your claims will be denied, and your revenue will shrink.

At the same time, patient responsibility has grown significantly. With more patients on high-deductible health plans, you must improve collections by offering upfront estimates, digital payment tools, and installment options. You also face staffing shortages in billing departments and the added pressure of shifting to value-based care. Without automation and clear workflows, these challenges will quickly erode your financial performance.

Related read: Revenue Cycle Management Healthcare Challenges

Managing the RCM process efficiently requires more than just operational workflows—smart technology, smooth integrations, and a strong compliance framework. As healthcare shifts toward automation and interoperability, many providers are turning to expert technology partners to modernize their revenue cycles.

Your RCM process cannot run on informal practices. You need formal policies that guide coding, billing, denial management, and patient engagement. Standardized coding reduces errors, while denial workflows ensure that rejected claims are quickly corrected and resubmitted. Without these, you leave revenue uncollected.

You also need to track key performance indicators such as denial rate, days in A/R, and net collection rate consistently. By monitoring these metrics, you can identify problems early and correct them. Policies that promote patient engagement, like transparent billing and cost estimates, will also strengthen collections and improve the patient experience.

Related read: Medical Billing vs Revenue Cycle Management

Do not sacrifice accuracy for speed. Revenue integrity ensures that every claim reflects the care provided, is coded correctly, and is compliant with payer rules. This protects you from audits and financial penalties while ensuring you are reimbursed for every service.

To strengthen revenue integrity, align clinical documentation with coding and billing practices. Use audit tools to catch discrepancies before submission, and train your staff on evolving payer requirements. Quarterly reviews of your revenue cycle can reveal trends and close financial leaks before they become major problems.

Related read: AI in Revenue Cycle Management

Mindbowser supports healthcare providers in building and optimizing each stage of the RCM process with customized tech solutions and expert consulting. Here’s how we help:

We build HIPAA-compliant RCM platforms that automate patient intake, charge capture, coding, claim submission, payment posting, and reporting. Our RCM software development solutions are scalable and designed around your specific workflow needs.

Our HealthConnect CoPilot accelerator supports fast, compliant integration with EHRs like Epic, Cerner, and Athenahealth EHR. We also streamline data flow between your existing PMS and billing systems to reduce redundancy and errors.

We create claim processing tools that track real-time claims, flag denials, and support root-cause analysis. Our solutions help teams rework claims quickly and identify denial trends to improve future submissions.

Mindbowser develops user-friendly portals and patient engagement tools to educate patients, send digital reminders, and enable payment plans or self-service billing. These improve transparency and drive faster collections.

We implement data analytics dashboards that give providers visibility into KPIs like Days in A/R, denial rates, collection efficiency, and patient payment trends—helping you make data-driven decisions.

Our team builds workflows that track provider credentialing status and maintain updated payer contracts. This ensures providers remain eligible to bill and helps avoid reimbursement delays.

We ensure interoperability and regulatory compliance by building solutions aligned with HIPAA, FHIR, and TEFCA standards, which are essential for clean claim submission and seamless payer-provider data exchange.

Whether you’re a hospital, clinic, or medical billing company, Mindbowser brings the tech expertise, healthcare domain knowledge, and security focus needed to streamline your RCM process from end to end.

Your revenue cycle directly affects the long-term financial sustainability of your organization. If you want to grow, you must maintain steady cash flow, minimize denials, and negotiate strong contracts with payers. A weak RCM process will limit your ability to invest in staff, technology, and new services.

Investors and partners also evaluate RCM efficiency during mergers and acquisitions. If your revenue cycle is clean and efficient, your organization will command higher valuations. At the same time, transparent billing strengthens patient loyalty, which supports revenue stability year after year.

Related read: Behavioral Health RCM Guide

You cannot improve your RCM process without measuring its performance. Tracking metrics such as first-pass acceptance rate, denial rate, average days in A/R, and net collection rate gives you a clear picture of your financial health. Failing short on any of these signals is a need for immediate corrective action.

Set up dashboards to monitor these metrics in real time and review them monthly with your leadership team. By taking a proactive approach to measurement, you ensure that issues are corrected before they become major revenue leaks. This discipline creates a cycle of continuous improvement in your financial operations.

Related read: Revenue Cycle Management in Medical Billing

You need to prepare today for the future of the healthcare revenue cycle management process. The industry is already shifting toward automation, AI-powered coding, and robotic process automation to eliminate manual tasks. If you do not adopt these tools, you will fall behind competitors that collect faster and more efficiently.

Patients also expect billing experiences that mirror retail transactions. You must provide mobile-first payment options, digital wallets, and financing plans. At the same time, interoperability with HL7 and FHIR will be necessary to ensure smooth data exchange. By embracing these innovations now, you position your organization for long-term success.

Related read: Healthcare Revenue Cycle Automation

Ready to take control of your revenue cycle? Let’s build a smarter RCM process—together.

Efficient RCM leads to improved cash flow, reduced claim denials, enhanced patient satisfaction, and overall financial stability.

Common challenges include claim denials, delayed payments, coding errors, and regulatory compliance issues.

Many healthcare organizations outsource RCM functions to specialized firms to leverage expertise and technology.

You measure success by monitoring key performance indicators such as denial rates, first-pass claim acceptance, days in A/R, and net collection rate. These metrics give you visibility into whether revenue is being collected efficiently or lost to errors and delays. You can learn more in our guide on Revenue Cycle Management in Medical Billing.

Automation eliminates repetitive tasks such as claim status checks, insurance verification, and payment posting. By reducing manual errors and freeing staff time, automation improves efficiency and increases reimbursement speed. For deeper insights, read our blog on Revenue Cycle Management Automation.

Revenue integrity ensures that your coding, documentation, and billing are accurate and compliant. This reduces the risk of audits and underpayments while protecting your reputation. By focusing on revenue integrity, you can achieve both compliance and financial sustainability. Our article on AI in Revenue Cycle Management explores how technology can strengthen this area.

We worked with Mindbowser on a design sprint, and their team did an awesome job. They really helped us shape the look and feel of our web app and gave us a clean, thoughtful design that our build team could...

The team at Mindbowser was highly professional, patient, and collaborative throughout our engagement. They struck the right balance between offering guidance and taking direction, which made the development process smooth. Although our project wasn’t related to healthcare, we clearly benefited...

Founder, Texas Ranch Security

Mindbowser played a crucial role in helping us bring everything together into a unified, cohesive product. Their commitment to industry-standard coding practices made an enormous difference, allowing developers to seamlessly transition in and out of the project without any confusion....

CEO, MarketsAI

I'm thrilled to be partnering with Mindbowser on our journey with TravelRite. The collaboration has been exceptional, and I’m truly grateful for the dedication and expertise the team has brought to the development process. Their commitment to our mission is...

Founder & CEO, TravelRite

The Mindbowser team's professionalism consistently impressed me. Their commitment to quality shone through in every aspect of the project. They truly went the extra mile, ensuring they understood our needs perfectly and were always willing to invest the time to...

CTO, New Day Therapeutics

I collaborated with Mindbowser for several years on a complex SaaS platform project. They took over a partially completed project and successfully transformed it into a fully functional and robust platform. Throughout the entire process, the quality of their work...

President, E.B. Carlson

Mindbowser and team are professional, talented and very responsive. They got us through a challenging situation with our IOT product successfully. They will be our go to dev team going forward.

Founder, Cascada

Amazing team to work with. Very responsive and very skilled in both front and backend engineering. Looking forward to our next project together.

Co-Founder, Emerge

The team is great to work with. Very professional, on task, and efficient.

Founder, PeriopMD

I can not express enough how pleased we are with the whole team. From the first call and meeting, they took our vision and ran with it. Communication was easy and everyone was flexible to our schedule. I’m excited to...

Founder, Seeke

We had very close go live timeline and Mindbowser team got us live a month before.

CEO, BuyNow WorldWide

Mindbowser brought in a team of skilled developers who were easy to work with and deeply committed to the project. If you're looking for reliable, high-quality development support, I’d absolutely recommend them.

Founder, Teach Reach

Mindbowser built both iOS and Android apps for Mindworks, that have stood the test of time. 5 years later they still function quite beautifully. Their team always met their objectives and I'm very happy with the end result. Thank you!

Founder, Mindworks

Mindbowser has delivered a much better quality product than our previous tech vendors. Our product is stable and passed Well Architected Framework Review from AWS.

CEO, PurpleAnt

I am happy to share that we got USD 10k in cloud credits courtesy of our friends at Mindbowser. Thank you Pravin and Ayush, this means a lot to us.

CTO, Shortlist

Mindbowser is one of the reasons that our app is successful. These guys have been a great team.

Founder & CEO, MangoMirror

Kudos for all your hard work and diligence on the Telehealth platform project. You made it possible.

CEO, ThriveHealth

Mindbowser helped us build an awesome iOS app to bring balance to people’s lives.

CEO, SMILINGMIND

They were a very responsive team! Extremely easy to communicate and work with!

Founder & CEO, TotTech

We’ve had very little-to-no hiccups at all—it’s been a really pleasurable experience.

Co-Founder, TEAM8s

Mindbowser was very helpful with explaining the development process and started quickly on the project.

Executive Director of Product Development, Innovation Lab

The greatest benefit we got from Mindbowser is the expertise. Their team has developed apps in all different industries with all types of social proofs.

Co-Founder, Vesica

Mindbowser is professional, efficient and thorough.

Consultant, XPRIZE

Very committed, they create beautiful apps and are very benevolent. They have brilliant Ideas.

Founder, S.T.A.R.S of Wellness

Mindbowser was great; they listened to us a lot and helped us hone in on the actual idea of the app. They had put together fantastic wireframes for us.

Co-Founder, Flat Earth

Mindbowser was incredibly responsive and understood exactly what I needed. They matched me with the perfect team member who not only grasped my vision but executed it flawlessly. The entire experience felt collaborative, efficient, and truly aligned with my goals.

Founder, Child Life On Call

The team from Mindbowser stayed on task, asked the right questions, and completed the required tasks in a timely fashion! Strong work team!

CEO, SDOH2Health LLC

Mindbowser was easy to work with and hit the ground running, immediately feeling like part of our team.

CEO, Stealth Startup

Mindbowser was an excellent partner in developing my fitness app. They were patient, attentive, & understood my business needs. The end product exceeded my expectations. Thrilled to share it globally.

Owner, Phalanx

Mindbowser's expertise in tech, process & mobile development made them our choice for our app. The team was dedicated to the process & delivered high-quality features on time. They also gave valuable industry advice. Highly recommend them for app development...

Co-Founder, Fox&Fork