Tired of long claim cycles, paperwork errors, and rising admin costs?

Claims processing software takes the pain out of managing claims by automating every step—from intake and validation to adjudication and payment. It’s the engine behind faster approvals, fewer mistakes, and happier customers. Whether you’re an insurer, healthcare provider, or TPA, this digital solution helps you handle claims faster, smarter, and with less effort.

In insurance and healthcare, where claims are constant and often complex, claims processing software plays a critical role. In insurance, it helps manage thousands of policyholder requests efficiently. Healthcare providers use it to handle medical reimbursements, while financial institutions rely on it to resolve fraud and liability claims. Across all these industries, delays or inaccuracies in claims can lead to compliance issues and unhappy customers, making software-based processing indispensable.

The benefits of using claims processing software are clear. Automation speeds up approvals, accuracy reduces errors and rework, and overall operational efficiency improves. Teams can shift focus from paperwork to high-value tasks, customer satisfaction rises, and organizations gain better control over compliance and reporting. As digital transformation deepens in 2025, claims processing software is becoming more intelligent, integrated, and essential than ever before.

Claims processing software is a technology platform that automates the end-to-end process of managing claims. It typically handles everything from claim intake and validation to adjudication, approval, and final settlement. The software minimizes manual intervention by enabling workflows that automatically route claims through predefined rules, ensuring faster turnaround times and greater accuracy.

This software is widely used by insurance companies, healthcare providers, financial institutions, and third-party administrators. In healthcare, for example, it integrates with EHR systems to validate eligibility and generate electronic claims. Insurance helps manage auto, property, and life insurance claims by centralizing all required documentation, communication, and decisions in one place.

Beyond automation, modern claims processing software often includes fraud detection, regulatory compliance, and analytics tools. Many systems also offer integration with CRMs, billing platforms, and APIs for wearable data or EHRs, especially in health-focused applications. By streamlining the claims journey, it not only improves internal efficiency but also enhances the claimant’s experience.

Related read: How We Help Build Scalable Healthcare Claims Management Software for Payers and Providers

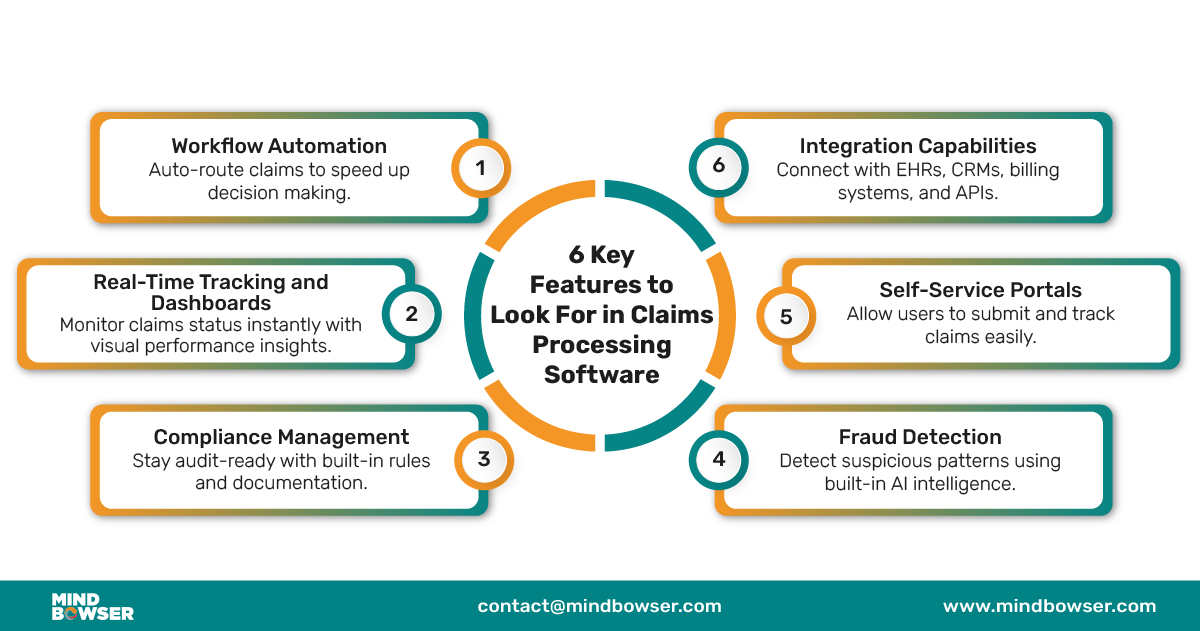

Modern claims processing software is pivotal in automating complex workflows, reducing errors, and meeting compliance standards. Here are the top features to consider when building software in 2025:

Workflow automation streamlines the process from intake to settlement by minimizing manual data entry, automating approvals, and routing claims based on predefined rules. This reduces processing time and eliminates human errors that can delay resolutions.

Real-time tracking tools give administrators and adjusters complete visibility into the status of claims and associated KPIs. Dashboards present actionable insights, allowing teams to identify bottlenecks, monitor team performance, and make informed decisions based on live analytics rather than retrospective reports.

Regulatory compliance is non-negotiable in industries like healthcare and insurance. Claims processing software ensures adherence to frameworks like HIPAA and GDPR by maintaining secure, auditable trails and generating detailed reports for internal and external audits, reducing the risk of penalties or data breaches.

AI-powered fraud detection systems analyze large volumes of data to spot irregular patterns or anomalies in real-time. This proactive approach helps prevent fraudulent activities, which can lead to significant financial loss. It also builds trust by safeguarding both payer and claimant interests.

Today’s users expect transparency and control. Self-service portals allow claimants to upload documentation, track claim progress, and receive updates without contacting support. This improves satisfaction while lowering the workload for customer service teams.

Claims processing software must fit within your existing tech ecosystem. The best platforms offer seamless integration with EHRs, CRMs, accounting tools, and document management systems, enabling smooth data exchange and continuity across all business processes.

Related read: Automating Insurance Claims Processing: From Manual Bottlenecks to Digital Precision

Implementing claims processing software isn’t just about automation—it’s about transforming how your organization handles every step of the claims journey. The right solution drives measurable improvements across operations, finance, and customer service, from faster approvals to fewer errors.

Automating each step of the claims journey—from intake to settlement—cuts processing time significantly. Claims processing software streamlines document capture, eligibility verification, and approval workflows, ensuring faster resolutions. Tools like ExdionHealth and FormX use AI-powered document recognition to shorten time-to-decision by reducing manual data entry and enabling real-time decision-making.

By automating repetitive administrative tasks, claims software reduces the need for large processing teams and minimizes overhead costs. According to 4decerto and SoftwareWorld, modern platforms cut manual input by up to 80%, lowering the cost per claim. Smart routing, batch processing, and centralized dashboards help teams do more with fewer resources.

Human error in manual claims handling can lead to rework, delays, and denied reimbursements. Claims processing software ensures consistent data capture, validation, and compliance checks, significantly improving accuracy. Solutions like FormX and V7 Labs utilize OCR and AI to reduce keystroke errors and flag inconsistencies before submission.

Faster turnaround times, transparent status updates, and easy digital submission options improve client trust. Self-service portals and real-time notifications—available in platforms like Capterra-reviewed tools—make it easier for users to track their claims. This creates a smoother experience and increases satisfaction for both patients and policyholders.

Compliance is built into most claims software platforms, whether it’s HIPAA, GDPR, or local insurance regulations. Automated audit trails, access controls, and documentation help organizations stay compliant without additional effort. Vendors such as ExdionHealth and 4decerto emphasize the importance of built-in rules engines and reporting modules to meet evolving legal and payer standards.

Related read: The Role of AI in Healthcare Claims Processing

Here’s a breakdown of some of the leading claims processing software options in 2025. Each brings unique strengths tailored to specific industries and business needs.

Guidewire ClaimsCenter is a powerful, enterprise-grade claims software built for high-volume carriers. Known for its extensive feature set and flexible configuration options, it supports the entire claims lifecycle—from first notice of loss (FNOL) to resolution. Its robust integrations and rules engine make it a preferred choice for complex insurance ecosystems.

Duck Creek Claims is a cloud-native platform for property and casualty (P&C) insurers. It offers end-to-end claims management with a strong focus on speed, flexibility, and modern user experience. The software supports API-based integrations and enables rapid deployment, allowing insurers to scale efficiently while meeting compliance standards.

Snapsheet delivers a digital-first claims experience with capabilities like virtual appraisals, automated workflows, and easy integration with mobile apps. It’s particularly valuable for carriers seeking to modernize their customer service and reduce cycle times using AI and automation. Snapsheet’s focus on virtual claims handling sets it apart in the market.

ClaimVantage specializes in cloud-based absence and claims management, making it a top choice for insurers handling disability, life, and absence claims. It supports automation, regulatory compliance, and data privacy standards like HIPAA. The platform also offers employer-facing solutions, bridging the gap between insurance and workforce management.

BriteCore offers an all-in-one solution that combines policy, billing, and claims functionality into a single cloud-based platform. Tailored for small to mid-sized carriers, it provides built-in business intelligence and automation tools that help improve operational efficiency. BriteCore stands out for its modern architecture and focus on long-term scalability.

ClaimPilot is a web-based claims management system popular among third-party administrators and smaller insurers. With features like online FNOL submission, document storage, and adjuster tracking, it’s designed for easy use and quick onboarding. Its browser-based interface makes it a flexible, low-overhead solution.

Claimable is a user-friendly claims management platform ideal for startups and mid-sized companies. It emphasizes simplicity without sacrificing functionality, offering configurable workflows, case tracking, and communication tools. Claimable is especially effective for businesses looking to digitize their claims process without heavy IT investment.

Ventiv Claims focuses on risk management and claims administration for large enterprises. The software provides robust analytics, incident tracking, and loss control tools. It’s built to handle high volumes while supporting strategic insights, making it a solid choice for organizations with complex risk profiles and compliance needs.

ClickClaims is known for its flexibility and configurability, allowing insurers to tailor workflows and reporting dashboards to their specific processes. It’s particularly well-suited for property claims and catastrophe response due to its scalability and mobile capabilities. ClickClaims enables faster deployment and better claims visibility.

HealthRules Payor is purpose-built for healthcare payers, offering advanced tools for claims adjudication, benefit configuration, and provider management. Its rule-driven engine supports efficient claims automation while ensuring regulatory compliance. This makes it a top choice for health insurers navigating complex billing and reimbursement scenarios.

Related read: How We Simplify Insurance Claims Processing for Healthcare Providers with Smart Tech

Choosing the right claims processing software can streamline operations, improve accuracy, and reduce turnaround time. To make the best decision, evaluating your organization’s needs across key technical and operational areas is important.

Start by understanding the types of claims your team processes and the average monthly or yearly volume. High-volume operations require more advanced automation, while smaller teams benefit from simpler interfaces. Knowing your claim complexity and frequency ensures you select a platform that supports your daily operations without overwhelming your staff.

Your claims software should easily connect with existing EHR, CRM, accounting, or ERP systems. Lack of integration can lead to data silos and duplicate efforts. A platform with open APIs and support for industry standards (like HL7 or X12) ensures smoother data flow and better coordination across departments.

As your organization grows or adds new services, your software must adapt. Scalable solutions can handle increasing data loads and users. At the same time, customization allows workflows and reporting to reflect your internal processes. Look for systems that support modular features or allow tailored configurations without complex rework.

Even the best software is only as effective as the support behind it. A vendor offering dedicated onboarding, thorough training modules, and responsive customer support helps your team adopt the system quickly. Check for 24/7 support availability, onboarding documentation, and live training options as part of your selection process.

Beyond licensing fees, consider setup costs, required IT resources, training expenses, and future upgrades. A cost-effective system will reduce claim processing expenses and improve settlement speed and accuracy, positively impacting your bottom line. Use ROI estimates based on error reduction and productivity gains to support decision-making.

Related read: AI for Claims Processing: How Insurers Can Reduce Costs and Improve Accuracy

Claims processing software is rapidly evolving to meet the growing speed, accuracy, and transparency demands. As 2025 unfolds, several tech-driven trends shape how claims are managed and settled across industries.

AI and machine learning are transforming claims processing from a manual-heavy task to a data-driven workflow. These technologies help automate claim triaging, detect anomalies, and flag potentially fraudulent submissions, resolution times and operational costs.

Blockchain is bringing much-needed transparency and security to the claims lifecycle. It enables tamper-proof records and real-time data sharing among stakeholders, reducing disputes and enhancing trust between payers, providers, and customers.

With mobile-first platforms, users can now file, track, and manage claims anytime, anywhere. These solutions improve claimant engagement and speed up data collection, especially during field assessments or emergency claims.

Predictive analytics tools within claims processing software help insurers and healthcare providers anticipate claim volumes, identify high-risk cases, and allocate resources efficiently, leading to smarter, faster decisions.

Tools like FlowForma are driving no-code process automation in claims handling. Teams can design and modify workflows without IT support, accelerating digital transformation and improving flexibility in rapidly changing business environments.

Related read: 18 Powerful Claims Processing Software Solutions Revolutionizing Healthcare in 2025

If you’re looking for a solution that gives you full control, without the recurring SaaS fees, vendor lock-ins, or rigid templates, Mindbowser is the right fit. We don’t just offer software; we build secure, scalable, and customizable claims processing systems tailored for your specific workflows.

Here’s what sets us apart:

Unlike SaaS platforms, where you rent software, with Mindbowser, you fully own the code and IP. That means:

Your data stays in your hands. We help ensure:

Forget hidden SaaS fees and scale penalties. With us, you get:

Need to plug into Epic EHR, Cerner EHR, or a legacy system? We specialize in:

Unlike SaaS tools with rigid workflows, we deliver:

We can embed smart features such as:

No waiting on vendor roadmaps. We offer:

We build what you need—nothing more, nothing less. That means:

If you’re tired of being limited by SaaS platforms and want a system built around your needs—with full ownership, control, and flexibility—Mindbowser can help you build the claims processing software you want to use.

👉 Talk to our team to get started.

Claims processing software has become a foundational tool for insurance providers, healthcare organizations, and TPAs aiming to handle claims faster, more accurately, and with fewer resources. It eliminates manual inefficiencies, reduces error rates, and provides real-time visibility into every stage of the claim lifecycle. With workflow automation, AI-driven fraud detection, and compliance-ready documentation, this software helps ensure claims are settled quickly and fairly, resulting in stronger provider-patient or insurer-client relationships.

As the industry evolves in 2025, adopting the right claims processing software is not just a smart move—it’s a necessity for staying competitive. Whether you’re a growing healthcare provider or an established insurer, now is the time to evaluate your current systems and identify gaps. Look for a solution that fits your needs, integrates with your existing tools, and supports your regulatory requirements. Today’s right investment can streamline operations, cut costs, and significantly improve stakeholder satisfaction.

It’s a tool that helps manage and automate the steps of handling a claim, from when it’s submitted to when it’s paid.

Insurance companies use software like Guidewire, Duck Creek, and Snapsheet to manage claims quickly and accurately.

Some of the top choices include HealthRules Payor, Kareo, and AdvancedMD. They help with billing, accuracy, and patient data.

It’s checking and handling insurance claims to ensure they are correct and then paying them.

We worked with Mindbowser on a design sprint, and their team did an awesome job. They really helped us shape the look and feel of our web app and gave us a clean, thoughtful design that our build team could...

The team at Mindbowser was highly professional, patient, and collaborative throughout our engagement. They struck the right balance between offering guidance and taking direction, which made the development process smooth. Although our project wasn’t related to healthcare, we clearly benefited...

Founder, Texas Ranch Security

Mindbowser played a crucial role in helping us bring everything together into a unified, cohesive product. Their commitment to industry-standard coding practices made an enormous difference, allowing developers to seamlessly transition in and out of the project without any confusion....

CEO, MarketsAI

I'm thrilled to be partnering with Mindbowser on our journey with TravelRite. The collaboration has been exceptional, and I’m truly grateful for the dedication and expertise the team has brought to the development process. Their commitment to our mission is...

Founder & CEO, TravelRite

The Mindbowser team's professionalism consistently impressed me. Their commitment to quality shone through in every aspect of the project. They truly went the extra mile, ensuring they understood our needs perfectly and were always willing to invest the time to...

CTO, New Day Therapeutics

I collaborated with Mindbowser for several years on a complex SaaS platform project. They took over a partially completed project and successfully transformed it into a fully functional and robust platform. Throughout the entire process, the quality of their work...

President, E.B. Carlson

Mindbowser and team are professional, talented and very responsive. They got us through a challenging situation with our IOT product successfully. They will be our go to dev team going forward.

Founder, Cascada

Amazing team to work with. Very responsive and very skilled in both front and backend engineering. Looking forward to our next project together.

Co-Founder, Emerge

The team is great to work with. Very professional, on task, and efficient.

Founder, PeriopMD

I can not express enough how pleased we are with the whole team. From the first call and meeting, they took our vision and ran with it. Communication was easy and everyone was flexible to our schedule. I’m excited to...

Founder, Seeke

We had very close go live timeline and Mindbowser team got us live a month before.

CEO, BuyNow WorldWide

Mindbowser brought in a team of skilled developers who were easy to work with and deeply committed to the project. If you're looking for reliable, high-quality development support, I’d absolutely recommend them.

Founder, Teach Reach

Mindbowser built both iOS and Android apps for Mindworks, that have stood the test of time. 5 years later they still function quite beautifully. Their team always met their objectives and I'm very happy with the end result. Thank you!

Founder, Mindworks

Mindbowser has delivered a much better quality product than our previous tech vendors. Our product is stable and passed Well Architected Framework Review from AWS.

CEO, PurpleAnt

I am happy to share that we got USD 10k in cloud credits courtesy of our friends at Mindbowser. Thank you Pravin and Ayush, this means a lot to us.

CTO, Shortlist

Mindbowser is one of the reasons that our app is successful. These guys have been a great team.

Founder & CEO, MangoMirror

Kudos for all your hard work and diligence on the Telehealth platform project. You made it possible.

CEO, ThriveHealth

Mindbowser helped us build an awesome iOS app to bring balance to people’s lives.

CEO, SMILINGMIND

They were a very responsive team! Extremely easy to communicate and work with!

Founder & CEO, TotTech

We’ve had very little-to-no hiccups at all—it’s been a really pleasurable experience.

Co-Founder, TEAM8s

Mindbowser was very helpful with explaining the development process and started quickly on the project.

Executive Director of Product Development, Innovation Lab

The greatest benefit we got from Mindbowser is the expertise. Their team has developed apps in all different industries with all types of social proofs.

Co-Founder, Vesica

Mindbowser is professional, efficient and thorough.

Consultant, XPRIZE

Very committed, they create beautiful apps and are very benevolent. They have brilliant Ideas.

Founder, S.T.A.R.S of Wellness

Mindbowser was great; they listened to us a lot and helped us hone in on the actual idea of the app. They had put together fantastic wireframes for us.

Co-Founder, Flat Earth

Mindbowser was incredibly responsive and understood exactly what I needed. They matched me with the perfect team member who not only grasped my vision but executed it flawlessly. The entire experience felt collaborative, efficient, and truly aligned with my goals.

Founder, Child Life On Call

The team from Mindbowser stayed on task, asked the right questions, and completed the required tasks in a timely fashion! Strong work team!

CEO, SDOH2Health LLC

Mindbowser was easy to work with and hit the ground running, immediately feeling like part of our team.

CEO, Stealth Startup

Mindbowser was an excellent partner in developing my fitness app. They were patient, attentive, & understood my business needs. The end product exceeded my expectations. Thrilled to share it globally.

Owner, Phalanx

Mindbowser's expertise in tech, process & mobile development made them our choice for our app. The team was dedicated to the process & delivered high-quality features on time. They also gave valuable industry advice. Highly recommend them for app development...

Co-Founder, Fox&Fork