Buy now, pay later services are increasingly becoming popular. As a result, there has been an immense growth of BNPL services amongst businesses such as E-commerce, where customer experience is vital for them. We have seen a gradual increase in the Buy now, pay later feature while having a transaction. These services experienced wide growth around the globe. As a result, the buy now, pay later is changing how people shop and impacting retailers’ business.

Buy now, pay later service is a way of short-term financing that allows consumers to purchase an item and pay for it later.

There is usually no additional charge for the customer- instead, the store that offers BNPL as a payment option pays a fee to the BNPL service provider.

Businesses use BNPL, especially E-commerce, to increase their conversion rates and average order value and grab the attention of new customers. Such services also act as an advantage for the customers. It allows customers to finance their purchases and pay them back in fixed installments.

For example, if a customer purchases $100, he will pay back in no-interest installments of $25. These payment methods give flexibility to the customers to finance large purchases.

Buy now, and pay later are typically presented as an option in the payment flow, with credit cards and other payment options. This makes it convenient and easy for the customers to use.

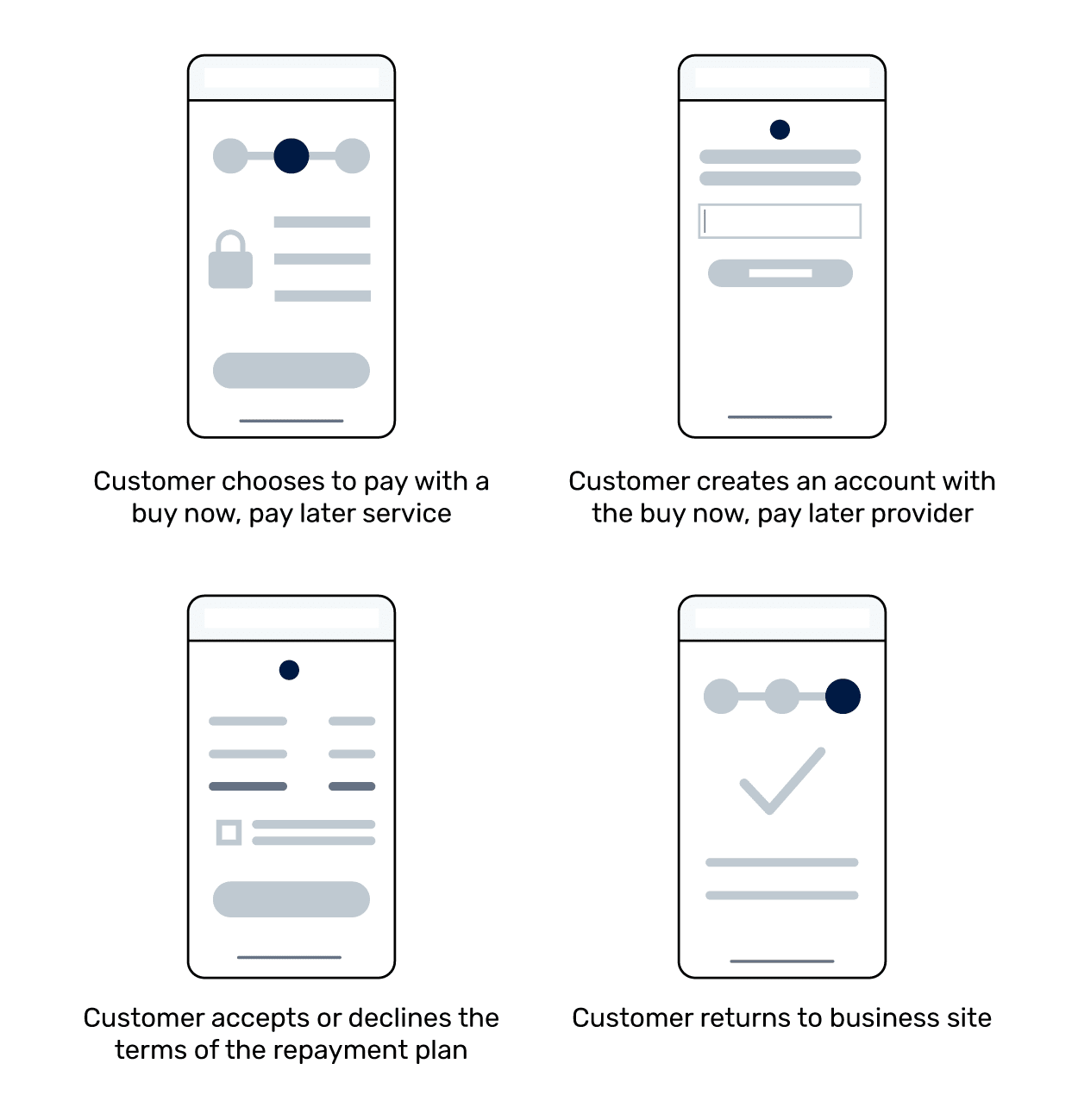

When customers make a purchase, they choose a buy now, pay later service in the payment form, redirecting them to the provider’s site or app. Customers can choose the repayment plan terms- selecting whether to go with weekly or monthly installments and then completing the purchase.

After a customer completes a purchase, the business receives the full payment minus any applicable fees. The customers later pay their installments to the BNPL services provider. In most cases, if the customer pays on time, there is no interest or additional fee.

The BNPL services require the users to set up an account and provide payment information. Then, when it’s time to pay, the BNPL service will automatically charge the customer’s payment method for the agreed-upon amount.

Offering your customers a frictionless checkout experience is key to keeping them happy and loyal- especially if your business is focused on E-commerce growth.

In addition, users usually have a customizable payment experience that allows them to choose how to make a payment. Buy now, pay later payment methods offers flexibility, and convenience and increase the conversion rate or average order value.

Below we have listed some benefits of BNPL services;

Businesses will receive the total transaction amount upfront immediately- regardless of whether or not the customer successfully pays their installments. This means that the buy now, pay later provider will take on all customer risk, protecting your business from fraud. In addition, the BNPL service provider handles the risk and associated costs if fraud-related disputes arise.

Offering a variety of payment methods allows you to create a relevant and convenient payment experience that attracts new customers. BNPL options are popular amongst customers who don’t have credit cards and want to opt for large purchases.

In addition, it established marketing channels, like a shop directory and email marketing, which could provide opportunities for you to connect to new customers.

BNPL payment services are a great way for customers to get financing quickly and easily. With most providers, there is no additional application fee, and customers can complete the payment process in just a few clicks. However, even the repayment plans and terms are straightforward. In addition, the payment process for returning customers is even easier.

Customers usually make payments when they can pay for the item later. BNPL services help reduce any burden of payments from the users. It’s less intimidating to make no-interest installments which drives customers to buy more. However, with BNPL services, you can always experience high conversion rates.

As we discussed earlier, BNPL services are convenient for customers who want to make large purchases but can’t make full up-front payments. With such services, businesses offer their customers to pay for their purchases in installments, making them more affordable. This encourages the customers to purchase more items since the payments are not all at once.

Selecting the most appropriate buy now, pay later provider depends on the types of products you sell, the price, and your customer base. Here are a few aspects you should consider when evaluating providers,

Depending on your business type, the average order value will be different. Businesses like E-commerce usually have a higher average order value. As a result, such businesses can always go for buy now, pay later providers that offer payment or repayment plans over a longer period. It can be either monthly installments over six months or yearly.

It’s important to pay attention to payment terms offered by the BNPL provider. This includes the length of the repayment period and the frequency of payments.

The credit limit for each customer will differ based on their purchase history, credit score, and repayment history. Therefore, some service providers have minimum and maximum credit limits.

Make sure you consider your average order value when choosing a provider to give customers enough credit to make a purchase successfully.

When deciding which markets you’d like to offer BNPL service, consider locating where your customers are. This may mean offering more than one BNPL provider to ensure maximum geographical coverage. You can also choose the BNPL service provider based on its popularity in that region.

Buy now, pay later can offer various benefits for customers. We have listed some of the advantages below;

⬆️ Increased Purchasing Power: BNPL allows a customer to make purchases they are not able to afford upfront. Such benefits can empower the customer to purchase from E-commerce businesses.

⬆️ Flexibility: With BNPL, the users offer flexibility in repayment options, allowing customers to choose the repayment schedules that can be suitable for them. The users can easily manage their finances and avoid late fees or penalties.

⬆️ No Interest: Many BNPL services or providers offer interest-free repayment plans, which make the customers make easier purchases and have no burdens of extra interest on the purchase.

⬆️ Convenience: BNPL services often offer quick and easy transactions, making it convenient for customers even during emergencies, whether they are online or in-store payments.

⬆️ Improved Credit Scores: Customer can easily increase their credit scores through the BNPL service by showing the payment history of on-time payments.

Mindbowser has offered multiple payment services using apps like Stripe to E-commerce companies. With the help of integrations, we make it possible to accept the buy now, pay later option. This makes it easier for E-commerce businesses to operate globally and provide customers with more payment options.

Related Read: Learn All About How Stripe Payment Works?

We offer services like;

We provide services with built-in payment support, allowing you to create a better customer payment experience.

Various payment API services like Stripe makes it easy to provide multiple payment options through a single integration. This means you can have a unified integration that involves minimal development time and is easy to manage, no matter which platform you choose to implement.

With various integration tools, E-commerce businesses can easily select payment methods by implementing a single line of code to automatically display the right payment methods and language based on IP and other signals.

The BNPL services allow your customers to pay you in their preferred payment method, whether it’s a credit card, debit card, or another type of payment. With our service handling payments, you can rest assured that everything is being taken care of while making things easier for both you and your valued customers.

You can start accepting buy now, pay later options with Mindbowser in lesser time. There is no additional application, onboarding, or underwriting process required. You can find out your eligibility for buy now, pay later service by talking to our expert. Our expert team will help you find the right choice and provide the integrations that suit you.

With Mindbowser, you can streamline your operational processes and reduce complexity by applying proper services. This includes “buy now, pay later” benefits, which makes reconciling your finances much easier.

We standardize the processes such as fulfillment, customer support, and refunds, so you can save time and focus on other areas of your business. Our experts monitor your activities and provide reporting of all the activities to help you make decisions for your business. Many E-commerce businesses need to have data for their customers and their actions; brief monitoring can help you track customer behavior toward payment methods and other engagements.

The Consumer Financial Protection Bureau (CFPB) recently released revealed staggering growth of Buy Now Pay Later loans in the U.S. from 2019 to 2021. The top five lenders saw an exceptional increase of 970% in the number of BNPL loans originated during the period. The statistics highlight a significant shift towards alternative payment options and indicate how increasingly popular BNPL is becoming popular as more consumers opt for this convenient and flexible payment method when purchasing luxury goods and services.

The age gap between 18-34 years has made a significant portion of BNPL users accounting for around 16% of the increase. According to a survey conducted the majority of BNPL users are US-based consumers. Diving into specifics, there are currently 79 million BNPL users located within the US, which is a significant increase of 56.1% from the year 2022.

We have discovered a few reasons why US consumers are widely using BNPL services. Paying interest on your credit cards can be overwhelming. Consumers are opting for BNPL services to avoid these credit card interests and to achieve the ability to borrow without a credit check. Another reason is to make large purchases that otherwise wouldn’t fit in the consumer’s budget.

Businesses have started to realize the value of better customer service, even regarding payment options. As a result, the buy now, pay later industry is constantly growing, and it’s a great way to increase sales. However, working with a reputable company is important to ensure you get the benefits without the risk.

You can connect to our expert and learn how to leverage the BNPL services for your E-commerce business. The BNPL services will benefit you in many ways to enrich your enterprises and customers’ experience with your business.

We worked with Mindbowser on a design sprint, and their team did an awesome job. They really helped us shape the look and feel of our web app and gave us a clean, thoughtful design that our build team could...

The team at Mindbowser was highly professional, patient, and collaborative throughout our engagement. They struck the right balance between offering guidance and taking direction, which made the development process smooth. Although our project wasn’t related to healthcare, we clearly benefited...

Founder, Texas Ranch Security

Mindbowser played a crucial role in helping us bring everything together into a unified, cohesive product. Their commitment to industry-standard coding practices made an enormous difference, allowing developers to seamlessly transition in and out of the project without any confusion....

CEO, MarketsAI

I'm thrilled to be partnering with Mindbowser on our journey with TravelRite. The collaboration has been exceptional, and I’m truly grateful for the dedication and expertise the team has brought to the development process. Their commitment to our mission is...

Founder & CEO, TravelRite

The Mindbowser team's professionalism consistently impressed me. Their commitment to quality shone through in every aspect of the project. They truly went the extra mile, ensuring they understood our needs perfectly and were always willing to invest the time to...

CTO, New Day Therapeutics

I collaborated with Mindbowser for several years on a complex SaaS platform project. They took over a partially completed project and successfully transformed it into a fully functional and robust platform. Throughout the entire process, the quality of their work...

President, E.B. Carlson

Mindbowser and team are professional, talented and very responsive. They got us through a challenging situation with our IOT product successfully. They will be our go to dev team going forward.

Founder, Cascada

Amazing team to work with. Very responsive and very skilled in both front and backend engineering. Looking forward to our next project together.

Co-Founder, Emerge

The team is great to work with. Very professional, on task, and efficient.

Founder, PeriopMD

I can not express enough how pleased we are with the whole team. From the first call and meeting, they took our vision and ran with it. Communication was easy and everyone was flexible to our schedule. I’m excited to...

Founder, Seeke

We had very close go live timeline and Mindbowser team got us live a month before.

CEO, BuyNow WorldWide

If you want a team of great developers, I recommend them for the next project.

Founder, Teach Reach

Mindbowser built both iOS and Android apps for Mindworks, that have stood the test of time. 5 years later they still function quite beautifully. Their team always met their objectives and I'm very happy with the end result. Thank you!

Founder, Mindworks

Mindbowser has delivered a much better quality product than our previous tech vendors. Our product is stable and passed Well Architected Framework Review from AWS.

CEO, PurpleAnt

I am happy to share that we got USD 10k in cloud credits courtesy of our friends at Mindbowser. Thank you Pravin and Ayush, this means a lot to us.

CTO, Shortlist

Mindbowser is one of the reasons that our app is successful. These guys have been a great team.

Founder & CEO, MangoMirror

Kudos for all your hard work and diligence on the Telehealth platform project. You made it possible.

CEO, ThriveHealth

Mindbowser helped us build an awesome iOS app to bring balance to people’s lives.

CEO, SMILINGMIND

They were a very responsive team! Extremely easy to communicate and work with!

Founder & CEO, TotTech

We’ve had very little-to-no hiccups at all—it’s been a really pleasurable experience.

Co-Founder, TEAM8s

Mindbowser was very helpful with explaining the development process and started quickly on the project.

Executive Director of Product Development, Innovation Lab

The greatest benefit we got from Mindbowser is the expertise. Their team has developed apps in all different industries with all types of social proofs.

Co-Founder, Vesica

Mindbowser is professional, efficient and thorough.

Consultant, XPRIZE

Very committed, they create beautiful apps and are very benevolent. They have brilliant Ideas.

Founder, S.T.A.R.S of Wellness

Mindbowser was great; they listened to us a lot and helped us hone in on the actual idea of the app. They had put together fantastic wireframes for us.

Co-Founder, Flat Earth

Ayush was responsive and paired me with the best team member possible, to complete my complex vision and project. Could not be happier.

Founder, Child Life On Call

The team from Mindbowser stayed on task, asked the right questions, and completed the required tasks in a timely fashion! Strong work team!

CEO, SDOH2Health LLC

Mindbowser was easy to work with and hit the ground running, immediately feeling like part of our team.

CEO, Stealth Startup

Mindbowser was an excellent partner in developing my fitness app. They were patient, attentive, & understood my business needs. The end product exceeded my expectations. Thrilled to share it globally.

Owner, Phalanx

Mindbowser's expertise in tech, process & mobile development made them our choice for our app. The team was dedicated to the process & delivered high-quality features on time. They also gave valuable industry advice. Highly recommend them for app development...

Co-Founder, Fox&Fork